Many traders ask me for the detailed descriptions of the Japanese candlestick patterns that are detected by the MT4 indicator Pattern Recognition Master. So, here is the list of the patterns that it can recognize with the corresponding chart pictures and signal descriptions:

Bearish patterns

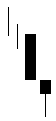

Shooting star. Can signal an end of the bullish trend. Should be confirmed by other patterns. The longer the shadow the stronger the signal.

Shooting star. Can signal an end of the bullish trend. Should be confirmed by other patterns. The longer the shadow the stronger the signal.

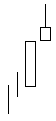

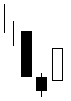

Evening star. Acts as a stronger trend reversal signal. Note that the shadows should be very short and the body of the middle candle should not be large as well.

Evening star. Acts as a stronger trend reversal signal. Note that the shadows should be very short and the body of the middle candle should not be large as well.

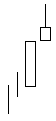

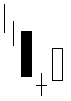

Evening doji star. Almost the same as previous, but some traders consider it a stronger signal.

Evening doji star. Almost the same as previous, but some traders consider it a stronger signal.

Dark cloud pattern. The

Dark cloud pattern. The

Bearish engulfing pattern. This

Bearish engulfing pattern. This

Bullish patterns

Bullish hammer. Can signal an end of a bearish trend. Should be confirmed by other patterns. The longer the shadow the stronger the signal.

Bullish hammer. Can signal an end of a bearish trend. Should be confirmed by other patterns. The longer the shadow the stronger the signal.

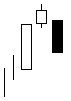

Morning star. Acts as a stronger trend reversal signal. Note that the shadows should be very short and the body of the middle candle should not be large as well.

Morning star. Acts as a stronger trend reversal signal. Note that the shadows should be very short and the body of the middle candle should not be large as well.

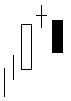

Morning doji star. Almost the same as previous, but some traders consider it a stronger signal.

Morning doji star. Almost the same as previous, but some traders consider it a stronger signal.

Piercing line pattern. The

Piercing line pattern. The

Bullish engulfing pattern. This

Bullish engulfing pattern. This

If you have never heard about Pattern Recognition Master before and do not want to detect these patterns on your own, then you can simply download this wonderful indicator.