One of the most obvious and easy ways to improve your trading results and organize the whole Forex trading process is to use a trade journal to log every trade that you make. Its an almost unknown fact among Forex beginners, but even some experienced traders still trade without such journal. Of, course some trading styles or types of psychological characters of the traders arent compatible with keeping a journal, but 99% of traders may still benefit from this simple and completely free tool.

I suggest logging every trade you make in a special trade journal. It can be an Excel (or OpenOffice Calc) table or a printed table, or anything else you may find usable for logging your trades. By maintaining a journal youll be able to see which trades were successful and which werent any why. Youll be able to improve your trading system and see your repeating mistakes. While many trading platforms (e.g. MT4) have account activity reporting feature that is useful to know your total profit/loss for the period, they dont offer a functionality of a real trade journal.

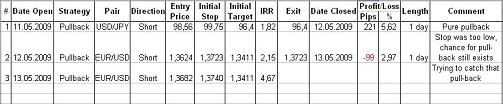

Here is the example of a trade journal that I keep. Its created as a Microsoft Excel table, which allows some calculation automation:

As you see there are 15 columns that I feel are required for a good trade journal:

Of course, other columns can be added for even greater logging informativeness but for me those are enough. If you have any questions, comments or recommendations regarding trade journals, please, feel free to reply below.

Update: Some traders asked me to share my trading journal table, so that they could use it to create their own trade journals. Here it is — download trade journal Excel table.

Updated 2: One year has passed and I’ve made a major update to a trade journal. Please, read more about it here: Advanced Forex Trade Journal.