- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 16, 2011

February 16

February 162011

King Cools Expectations for Interest Rates Hike, Sterling Drops

The Great Britain pound weakened today after Bank of England Governor Mervyn King suggested that the Bank isn’t ready for the interest rates hike. The inflation exceeded the target of the BoE for more than a year, causing the Governor to write the explanation to Chancellor George Osborne. This letter fueled hopes for the increase of the interest rates. King cooled these expectations today at the press conference about the Inflation Report in London: The market has gotten it […]

Read more February 16

February 162011

Australian Dollar Rises as Asian Stocks Gain

The Australian dollar recovered from the two-year low after the Asian stocks advanced, increasing demand for the higher-yielding currencies. The MSCI Asia Pacific Index of shares gained 0.3 percent. The minutes of the Monetary Policy meeting of the Reserve Bank of Australia’s board signaled that an increase of the interest rates may be performed in the near future: Given the medium-term outlook for the economy, and the limited amount of spare capacity that existed, members judged that this slightly […]

Read more February 16

February 162011

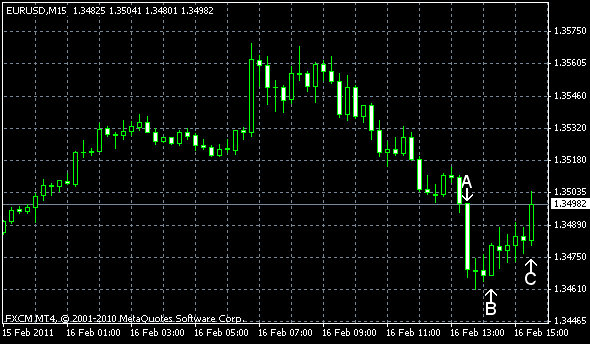

EUR/USD Trades Flat After Release of US Economic Reports

EUR/USD was sliding today before the macroeconomic reports from the US were released. The reports showed that US economic growth was slower than estimated, allowing the euro to strengthen a little. EUR/USD now trades almost flat at 1.3502 after jumping as high as 1.3570. Building permits were at a seasonally adjusted annual rate of 562k in January, almost at the predicted value of 570k and below the revised December rate of 627k. Building permits […]

Read more February 16

February 162011

Great Britain Pound Rises as BOE Governor Expects High Inflation

The Great Britain pound gained as Bank of England Governor Mervyn King was hawkish about the inflation, causing the speculation that the Bank may raise the interest rate soon. King wrote in his letter to Chancellor George Osborne: Inflation is likely to continue to pick up to somewhere between 4% and 5% over the next few months, appreciably higher than when I last wrote to you. That primarily reflects further pass […]

Read more