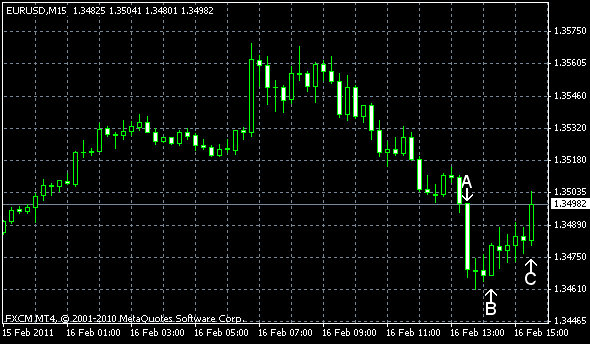

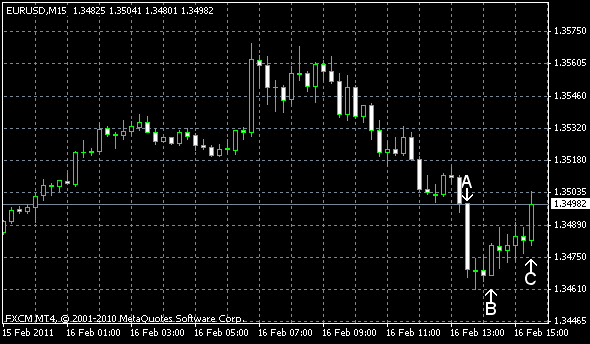

EUR/USD was sliding today before the macroeconomic reports from the US were released. The reports showed that US economic growth was slower than estimated, allowing the euro to strengthen a little. EUR/USD now trades almost flat at 1.3502 after jumping as high as 1.3570.

Building permits were at a seasonally adjusted annual rate of 562k in January, almost at the predicted value of 570k and below the revised December rate of 627k. Building permits were at a seasonally adjusted annual rate of 596k in January, above the forecast value of 550k and the revised December estimate of 520k.

PPI rose 0.8% in January, seasonally adjusted, following the increase of 0.9% in December. The analysts predicted the growth to remain at the December rate (0.9%).

Industrial production and capacity utilization slowed in January and were below forecasts. Industrial production decreased 0.1% in January 2011 having risen 1.2% in December. It was predicted to rise 0.5%. Capacity utilization rate edged down from 76.2% to 76.1%. Forecasts suggested the 76.4% rate.

Crude oil inventories increased by 0.9 million barrels and total motor gasoline inventories increased by 0.2 million barrels last week. Both are above the upper limit of the average range.

If you have any comments on the recent EUR/USD action, please, reply using the form below.