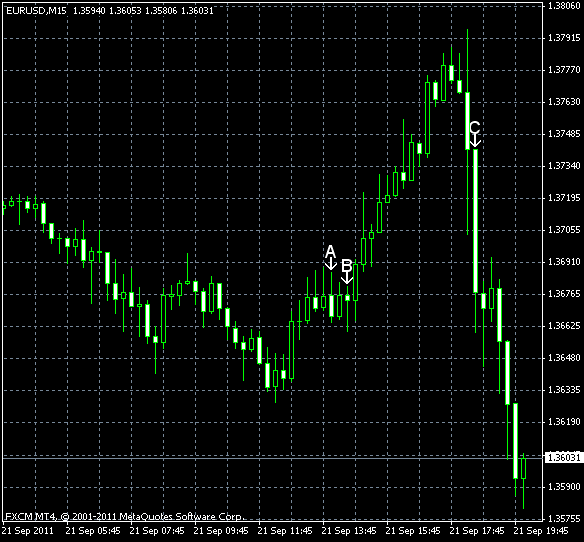

EUR/USD was steadily rising this trading session, but slumped sharply after the Federal Market Open Committee announced it’s going to expand their holdings of

Existing home sales rose to the seasonally adjusted annual rate of 5.03 million in August from the upwardly revised 4.67 million in July. Forecasts were more modest, promising 4.76 million. (Event A on the chart.)

Crude oil inventories decreased by 7.3 million barrels from the previous week and total motor gasoline inventories increased by 3.3 million barrels last week. (Event B on the chart.)

The Federal Open Market Committee maintained the federal funds rate at 0 to 0.25 percent range. (Event C on the chart.) The FOMC increased its holdings of longer maturity securities:

The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less. This program should put downward pressure on

Yesterday, a report about housing starts and building permits was released, showing that housing was at 571k in August, compared to 601k in July, and building permits was at 620k, compared to the July value of 601k. The values are seasonally adjusted. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.