- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 22, 2011

September 22

September 222011

US Dollar Rises Further as Traders Shun Risk

The US dollar continued its upward movement today as yesterday’s statement of the Federal Reserve continues to force Forex traders to shun risk and to seek safety. The yen outperformed the dollar as a safe currency. The yesterday’s announcement of the Fed put the Forex market in the risk aversion mode and it’s still in place, bolstered by the signs of a slower economic growth in China. The greenback benefits from this situation as a refuge currency. The Dollar Index, tracking the US currency versus […]

Read more September 22

September 222011

CAD Falls Below Parity with USD After Fed Statement

Yesterday’s monetary policy statement of the Federal Reserve had a very negative effect on the Canadian dollar. The growth-linked currency posted the biggest decline since May 2010 today, dropping below parity with the US dollar for the first time since January 2011. The Fed announced yesterday that it’s replacing its short-term debt with longer-maturity securities. The US central bank mentioned about “significant downside risks” to the US economic growth. […]

Read more September 22

September 222011

NZ Dollar Drops as Economic Growth Stalls

The New Zealand dollar slumped today after the report showed that the nation’s economic growth almost stalled in the second quarter of this year. New Zealand’s gross domestic product rose 0.1 percent in the second quarter of 2011. That’s compared to the median forecast of 0.5 percent and the 0.9 percent growth in the first quarter. Reserve Bank of New Zealand Governor Alan Bollard signaled the central bank doesn’t feel need to raise the interest […]

Read more September 22

September 222011

Aussie Below Parity with Greenback

The Australian dollar dropped below the parity level with its US counterpart as signs of slower manufacturing in China and falling stocks weakened demand for Australia’s currency. The HSBC preliminary manufacturing Purchasing Managers’ Index dropped to 49.4 in September from 49.9 in August. That’s the lowest level in two months. The MSCI Asia Pacific Index of stocks dropped as much as 4.1 percent, while the Stoxx Europe 600 Index lost 4.2 percent. AUD/USD […]

Read more September 22

September 222011

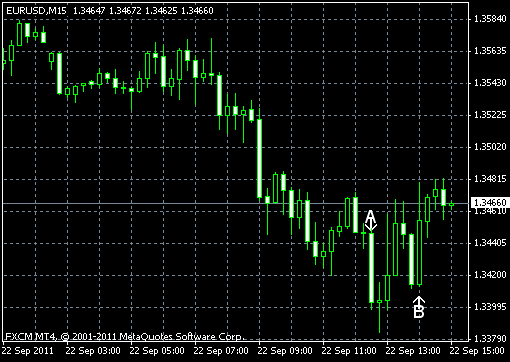

EUR/USD Extends Drop Despite Good Signs

EUR/USD extended its yesterday’s drop as risk aversion, spurred by the FOMC statement, continues to affect the Forex market. The fundamentals today weren’t very bad, actually, as jobless claims decreased and leading indicators rose. Initial jobless claims decreased to 423k from 432k in the week ending September 17. The actual value was near the forecast value of 419k. (Event A on the chart.) Leading indicators increased 0.3% in August, following the 0.6% increase in July […]

Read more September 22

September 222011

Dollar Jumps as Fed Expands Bond Purchases

The US dollar jumped after the Federal Reserve announced it’s going to increase purchases of longer-term securities. The resulting surge of demand for safer currencies was beneficial for the dollar. The Federal Open Market Committee left the federal funds rate at 0 to 0.25 percent range. The FOMC wrote in its statement: The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell […]

Read more