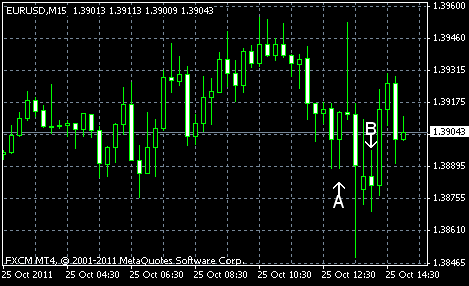

EUR/USD was trading flat for the most part of today’s trading session, but later started to decline. At present, the currency pair rebounded and is trading near its opening level as the fundamental data from the US was unexpectedly bad. Most reports showed worsening condition of the US economy and all of them were worse than forecasts.

S&P/

Richmond Fed manufacturing index stayed at -6 in October, the same value as in September. That’s a disappointment for traders as analysts predicted an increase to 2. Value below 0 indicates worsening conditions for manufacturers. (Event B on the chart.)

Consumer confidence index dropped to 39.8 in October from 46.4 in September (revised from 45.4). That was yet another disappointment as forecast value was 46.1. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.