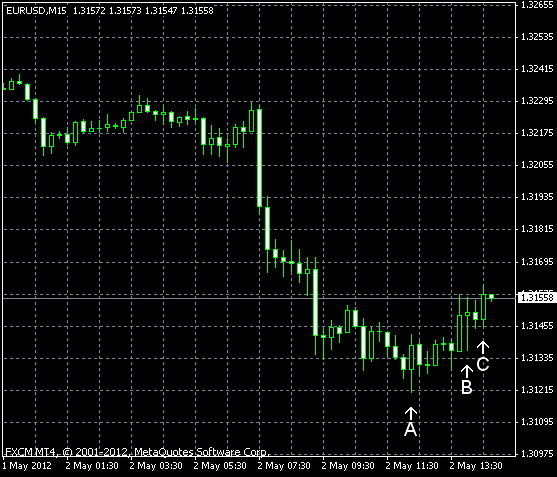

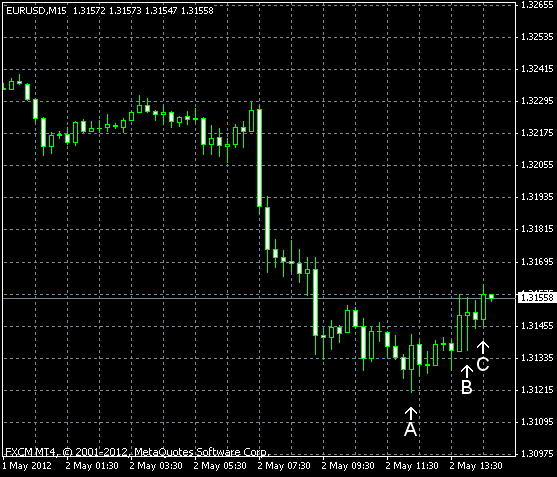

EUR/USD sank today as negative macroeconomic data from Europe drove investors away from the common currency of the eurozone. That was very fortunate for the dollar as US fundamentals also were not particularly good. Employment grew less than expected, at least according to the report of Automatic Data Processing. If the slower growth will be confirmed by

ADP employment rose by 119k from March to April on a seasonally adjusted basis, being below the forecast figure of 178k. The March gain was revised down from 209k to 201k. (Event A on the chart.)

Factory orders edged down 1.5% in March, exactly as forecasters predicted. The February change was revised from 1.3% to 1.1%. (Event B on the chart.)

Crude oil inventories increased by 2.8 million barrels last week and are in the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 2.0 million barrels and are in the middle of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.