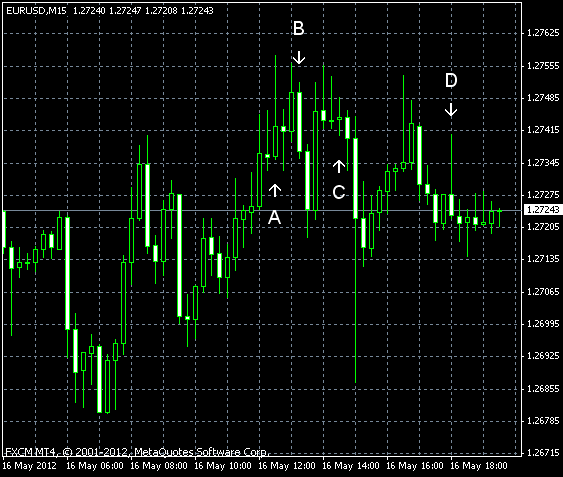

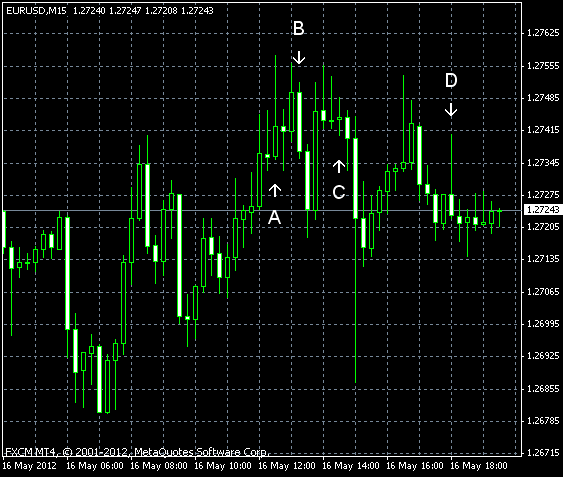

EUR/USD fluctuated today. The euro is still suffering from the crisis in Europe, while the dollar was weighed down by prospects of additional stimulus. Today’s reports from the US were good, but fears that the US recovery is not stable enough persist.

Housing starts were at the seasonally adjusted annual rate of 717k in April, above the revised March estimate of 699k and the predicted value of 690k. Housing starts were at the seasonally adjusted annual rate of 715k in April, down from the revised March rate of 769k and in line with forecasts of 730k. (Event A on the chart.)

Industrial production and capacity utilization rose more than expected in April. Industrial production was up 1.1%, compared to the expected 0.6%. Capacity utilization rate was 79.2%, compared to the predictions of 78.9%. Production fell 0.6% and utilization was at 78.4% in Mach. (Event B on the chart.)

Crude oil inventories increased by 2.1 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 2.8 million barrels and are in the lower limit of the average range. (Event C on the chart.)

Minutes of FOMC monetary policy meeting showed that the US central bank is still considering quantitative easing:

Several members indicated that additional monetary policy accommodation could be necessary if the economic recovery lost momentum or the downside risks to the forecast became great enough.

Taking into account the recent weak employment data, it is not surprising that the Federal Reserve did not reject QE3 outright, even as the US economy remain on track to recovery. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.