- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 20, 2012

December 20

December 202012

Yen Sheds Gains as BoJ Suggests Aggressive Monetary Policy

The Japanese yen was rising at the start of today’s trading session, but lost its gains as the Bank of Japan boosted its stimulating measures, confirming expectations that the central bank will conduct more aggressive policy with the new government. The BoJ kept its main interest rate near 0–0.1 percent and expanded its asset purchase program by ¥10 trillion to ¥101 trillion. The bank noted that “overseas economies remain […]

Read more December 20

December 202012

Euro Slips as Risk Appetite Evaporates

Euro has slipped into negative territory today against the US dollar as earlier risk appetite all but evaporates. There is little support the euro right now, and the US dollar is gaining the upper hand as a result. The latest news out of the United States is putting a damper on the Forex market today. First of all, the fiscal cliff negotiations began breaking down as House Speaker John Boehner began pushing […]

Read more December 20

December 202012

Slowing New Zealand’s Growth Does Not Make Kiwi Soft

The New Zealand dollar attempted to rally today even after the data showed slowing economic growth in the South Pacific country. The kiwi was a little higher versus the greenback and erased its losses against the yen. New Zealand’s gross domestic product grew 0.2 percent in the third quarter of 2012 from the previous quarter, slower than analysts have predicted — 0.4 percent. Moreover, the previous reading was revised from 0.6 […]

Read more December 20

December 202012

US Dollar Lower Against Other Majors, But Paring Losses

US dollar is a lower against other majors right now, but the currency is paring its losses as uncertainty threatens to come creeping back into the markets. High beta currencies are higher against the greenback for now, but they are losing some ground, and threatening to move lower. A lot of what has been providing risk appetite in the markets is starting to unravel a little bit. There is enough […]

Read more December 20

December 202012

Mexican Peso Slides as Fears of Fiscal Cliff Return

The Mexican peso fell today on fears that US politicians will not reach an agreement for avoiding the fiscal cliff, endangering economic growth of the United States and damping prospects for Mexican exports. There are speculations that between among President Barack Obama and Republican House Speaker John Boehner stalled. Absence of agreement will lead to automatic spending cuts and tax increases that may throw the USA into recession. That […]

Read more December 20

December 202012

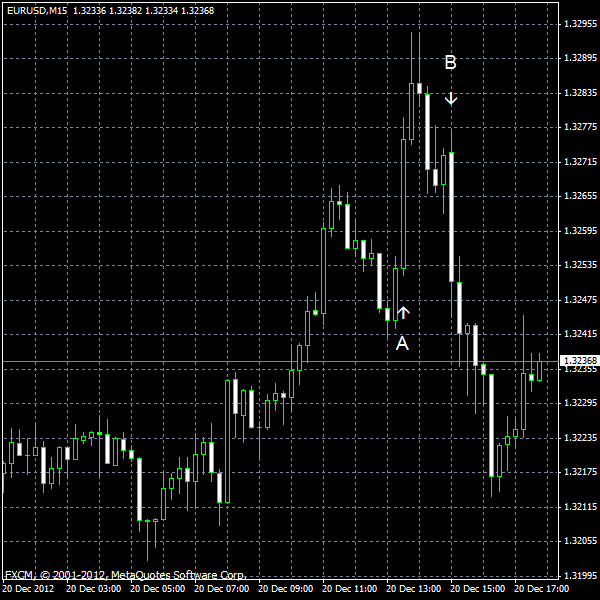

EUR/USD Fluctuates as US Politicians Vote for Plan B

EUR/USD was volatile today, but is trading near the opening level now, as the US House of Representatives is going to vote for Speaker John Boehner’s “plan B” that includes extending tax breaks, while increasing tax on rich people at the same time. Most data from the United States was much better than expected. Some reports, including jobless claims and the leading index, deteriorated, but were in line […]

Read more December 20

December 202012

Czech Koruna Soft After Central Bank Leaves Rates Unchanged

The Czech koruna fell today after the Czech central bank left interest rates unchanged yesterday and analysts speculated that it may weaken the currency to support the declining nation’s economy. The Czech National Bank kept its main interest rate at 0.05 percent yesterday. Economists speculated that the bank may weaken the koruna, even though Governor Miroslav Singer noted that the exchange rate is already weak: The koruna […]

Read more