- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 15, 2014

September 15

September 152014

Swiss Franc Weakened by Negative Interest Rates Speculations

The Swiss franc dropped today on speculations that the Swiss National Bank will implement negative interest rates as a measure to keep the currency weak and to help the nation’s economy overcome its problems. The SNB set a cap on the franc back in 2011, effectively pegging it to the euro. With the European Central Bank implementing negative interest rates, the SNB may be forced to take the same route in order to maintain the ceiling. Today’s data from […]

Read more September 15

September 152014

Yen Higher Now, but Will It Last?

Yen is higher today, thanks in large part to the fact that China’s weak data is prompting strong risk aversion. Even though the yen is higher now, though, there are many who think that the yen will move lower in the future, due to the fact that the Japanese government is running out of options. Right now, the yen seems to be correcting a little bit from its huge […]

Read more September 15

September 152014

Weak Chinese Data Hits the Euro

Euro would have been weakening anyway, thanks to recent efforts from the ECB, but weak Chinese data is weighing on risk appetite, and the euro is down across the board. Euro is down today, thanks in large part to the fact that there are a lot of factors weighing on the 18-nation currency. The fact that the ECB continues to take steps to stimulate the economy is sending the euro lower, as are concerns about […]

Read more September 15

September 152014

Aussie Opens Sharply Lower After China’s Data

The Australian dollar opened sharply lower today due to worse-than-expected economic data from China released over the weekend. While the currency bounced from daily lows, it is still far below the Friday’s closing rate. Several reports from China were released over the weekend, and they all were disappointing. Among them was industrial production data that showed annual growth of 6.9 percent in August, which […]

Read more September 15

September 152014

EUR/USD Dips as Traders Wait for FOMC Statement

The majority of Forex market participants continue to bet on an interest rate hike in the near future, driving the US dollar higher. They anxiously wait for the outcome of the two-day policy meeting of the Federal Open Market Committee this week, hoping to see hints about timing of such hike in a central bank’s statement. EUR/USD bounced off the session’s lows after the worse-than-expected industrial production report but remained below the opening level. NY Empire […]

Read more September 15

September 152014

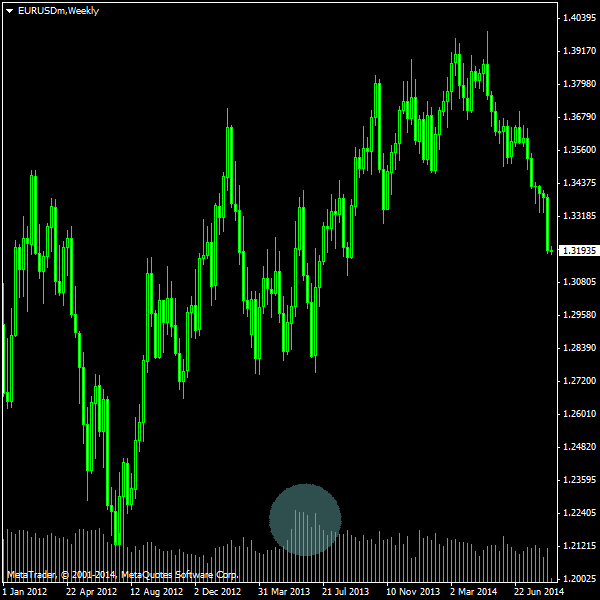

Do You Believe in Forex Tick Volume?

Quite often, I get requests from Forex traders to implement this or that indicator or expert advisor that applies tick volume to analyze or trade currency pair. Tick volume that is present in every MetaTrader platform is based on the number of price updates (ticks) that come during the formation of a given bar. At first glance, it seems to be a good approximation of real volume, but in reality it is a poor […]

Read more