EUR/USD rose during Wednesday’s quiet trade. With no major news, market analysts argued for the reasons for the rally. Some were saying that it was a sign that traders do not expect an interest rate hike from the Federal Reserve, while others speculated that it was just a result of

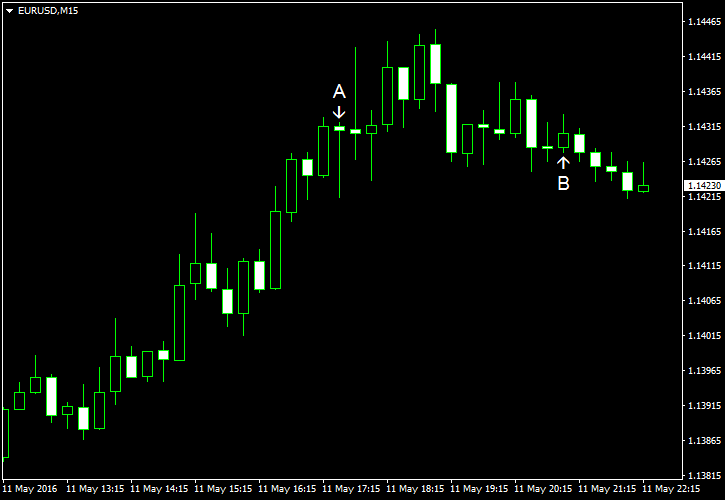

US crude oil inventories dropped by 3.4 million barrels last week, though remained near historical records. It surprised market participants who had expected a small increase by 0.1 million. The stockpiles were up by 2.8 million the week before. Meanwhile, total motor gasoline inventories dropped by 1.2 million barrels but remained far above the upper limit of the average range for this time of year. (Event A on the chart.)

Treasury budget turned from the deficit of $108.0 billion in March to the surplus of $106.5 billion in April. Analysts were counting on a bigger excess of $116.2 billion. (Event B on the chart.)

Yesterday, a report on wholesale inventories was released, showing a small increase by 0.1% in March versus the forecast 0.2%. The indicator fell 0.6% in February (revised). (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.