Contents

- 1 Market sentiment

- 2 Speeches

- 3 Economic data

- 4 Nowcasts of GDP

- 5 Projections

- 6 Conclusion

Following the dovish remarks of the FOMC’s decision to keep interest rates unchanged in March and an even less optimistic statement in April, markets had lowered their expectations for interest rate hikes this year. By

Market sentiment

If we look at the current market bets regarding the upcoming interest rate decision, we will see only a 3.8% chance of a 0.25 basis points hike by the FOMC.

current market bets

However, it was much higher before the latest

current market bets

The optimism of those who anticipate a higher Fed funds rate rose after the release of the April meeting’s minutes on May 18. The minutes stated that the market participants interpreted the Fed’s stance as “more accommodative than expected.” Basically, it means that the FOMC has been surprised by how the markets had almost completely dismissed the possibility of June rate increase. The minutes also reiterated that the upcoming changes to the interest rate will be based on the incoming data.

A sentiment barometer of interest rate hike likelihood shared by the Wall Street Journal suggests a 31.4% probability. It is based on estimates of 60+ economists surveyed by the company. Unfortunately, the latest survey was conducted in May and the data is not very accurate as of today.

Update 2016-06-11: According to the June edition of the WSJ Econ Forecast, the probability of a rate hike in June is down to 6.3%. The surveyed economists see 52.4% probability of July rate hike.

Speeches

Now, let’s look at what official commentary and data we have had since FOMC’s two last meetings.

Fed’s Governor Jerome Powell spoke at the Peterson Institute for International Economics on May 26, 2016. His speech was rather dovish concerning the

Lower potential output growth would mean that interest rates will remain below their

At the same time, he is ready to act “soon” if the incoming data supports his expectations of US economy moving to 2% annual growth rate:

Depending on the incoming data and the evolving risks, another rate increase may be appropriate fairly soon.

Janet Yellen sounded rather hawkish in her unofficial talk at Radcliffe Institute for Advanced Study on May 27:

It’s appropriate, and I’ve said this in the past, I think for the Fed to gradually and cautiously increase our overnight interest rate over time and probably in the coming months, such a move would be appropriate

On May 30, St. Louis Fed President James Bullard (a FOMC member), spoke at the Bank of Korea in Seoul, Korea. Although his academic talk was rather general and dedicated mostly to credit markets and labor force participation, he mentioned one important thing: When a central bank is threatened with the zero lower bound and needs to provide stimulus, it is much healthier (for the credit markets) to keep a positive nominal rate and instead provide a “

In her June 3 speech at the Council on Foreign Relations, Fed Governor Lael Brainard talked about the most recent developments in the US economy and their implications for the future monetary policy. It is important to note that she spoke after the release of the latest dismal NFP report and her speech can be described as rather dovish. She said that there are signs of firming of inflation, but that the risks of not returning to 2% target are rather high. She told that markets are expecting only gradual monetary tightening and any surprise here would cause turbulence. Later in the speech, she almost literally tells us that the next interest rate increase is better moved to July:

I want to emphasize that monetary policy is data dependent and is not on a preset course. […] Recognizing the data we have on hand for the second quarter is quite mixed and still limited, and there is important

On June 6, Boston Federal Reserve President Eric Rosengren gave a speech on Perspectives on Quantitative Easing in the United States at the Central Banking Series: Helsinki conference. Among other things, he noted that the US economy is recovering from the crisis and that all the metrics followed by the Federal Reserve are nearing their target level. He seems to be eager to raise the interest rate, but is inclined to wait at least until July to do so due to the recent soft employment report:

Given that the labor market contrasts with the pattern in the first quarter, and the

In her June 6 speech at the World Affairs Council of Philadelphia, Chairperson Janet Yellen was full of optimism but reminded the market participants about a range of uncertainties that may endanger the gradual reduction of monetary policy accommodation. Among those uncertainties, she cited the Friday’s poor employment report and the UK referendum (June 23). It seems that she is also inclined to wait for July to let some of these uncertainties to go away:

My colleagues and I will make our policy decisions based on what incoming information implies for the economic outlook and the risks to that outlook. What is certain is that monetary policy is not on a preset course, and that the Committee will respond to new data and reassess risks so as to best achieve our goals.

Economic data

Looking at the economic reports we had since the last monetary policy meeting (April 26–27) in the USA helps assessing the chances of interest rate increase.

On April 28, an advance report on Q1 GDP has shown 0.5% growth vs. 0.7% forecast and compared to Q4 2015 gain of 1.4%. It was not a very optimistic piece of data. The second estimate report on the Q1 GDP has shown an increase by 0.8%, which was in line with the optimistic forecasts.

The next day, the core PCE inflation report went out with 0.1% monthly change vs. 0.1% forecast and below the March’s value of 0.2%. It also had no positive signals for the interest rates increase prospects. April core PCE report released on May 31, was not bad, showing 0.2% growth vs. 0.2% forecast.

A

The overall picture should also be supplemented by the news releases that were going out before April meeting but after the March meeting.

We had some good news on Q4 2015 final GDP — 1.4% vs. 1.0% forecast. Core PCE inflation data for February was rather weak: 0.1% vs. 0.2% forecast and down from January’s 0.3%.

If you compare US macroeconomic data released before before April meeting and the data we currently face before June meeting, you will notice that the former was even better, but did not warrant for an interest rate tightening from the FOMC’s point of view. It looks like there is no objective reason to expect June hike based on the US macroeconomic data.

Nowcasts of GDP

The Federal Reserve Bank of New York releases GDP forecasts for the current quarter (so called nowcasts) on a weekly basis. They are based on the latest macroeconomic releases available during the time of nowcast report. The latest one (June 3) shows 2.37% as the probable Q2 GDP growth value — higher than 2.15% released on May 27 — meaning that the recent NFP failure did not prevent the forecasters from raising the GDP expectations. We will see one more nowcast report from NY Fed before the June 15 interest rate decision — on June 10. The NY Fed will not release its June 10 nowcast due to “FOMC blackout period.”

The Federal Reserve Bank of Atlanta shares the nowcast of GDP based on its own economic model. The forecast is recalculated upon each release of important economic indicators from the United States. The latest report (June 3) shows 2.5% as the probable GDP growth in the second quarter of 2016. Interestingly, the nowcast was not altered by the June 3 employment report. We will see two more nowcast reports from the Atlanta Fed before the FOMC meeting — on June 9 and on June 14.

Update 2016-06-11: In its June 9 forecast, the Atlanta Fed’s model continued to show 2.5% growth rate for Q2 gross domestic product.

Update 2016-06-14: Today’s Atlanta Fed nowcast brought the expected Q2 GDP growth figure up to 2.8%, which seems absolutely optimistic for the interest rate outlook in the USA.

Wall Street Journal polls a number of economists to come up with monthly projections of GDP figures. In its May edition, the value stands at 2.2% for Q2 2016 and at 1.9% annual growth for the whole of 2016.

Update 2016-06-11: In June edition, the Q2 forecast increased to 2.4% with the annual 2016 growth forecast rising to 2.0% according to the WSJ survey.

The Federal Reserve Bank of Philadelphia issues quarterly surveys of professional forecasters. The Q2 2016 forecast, which was released on May 13, projects 2.1% growth on the quarterly basis and 1.7% growth on the annual basis. Unfortunately, the data is a bit stale already and is probably less meaningful compared to the previous three nowcasts.

Projections

To put the actual data we already have at the moment and the nowcasts from the respectable institutions into perspective, we can look at the projections that have been released by the FOMC for its March meeting.

As you can see in the linked file, the Fed expects 2016 GDP growth at 2.2% (1.9%-2.5% range). None of the actual data we have so far supports this, however, the nowcasts mentioned above point at the likelihood of getting to that growth rate by the second quarter of 2016.

Unemployment is expected to reach 4.7% (4.5%-4.9% range) by the end of 2016, which is exactly where we are now according to the latest reports. And that is in spite of the low number of jobs added during the last three months. But let’s not forget that the FOMC is tracking the overall unemployment rate and not the

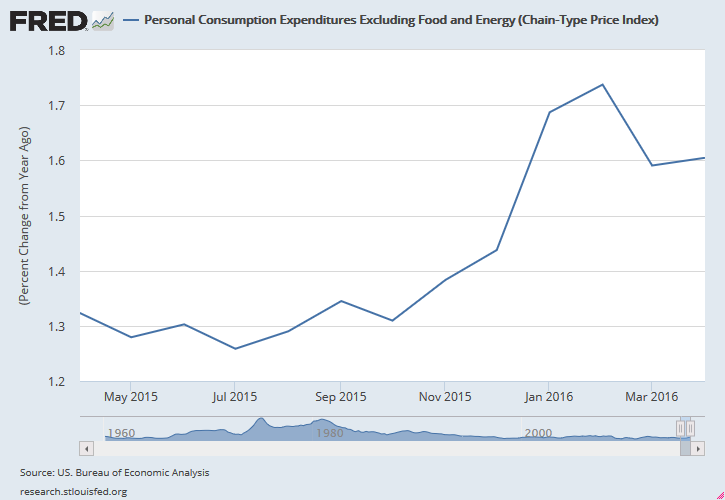

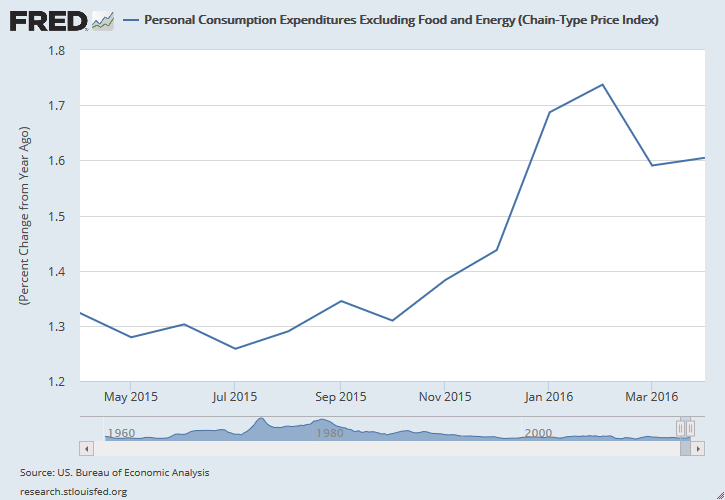

Core PCE inflation is projected at 1.6% (1.4%-2.1% range) for 2016. Another projection that seems to be in line with the current situation:

Conclusion

My personal impression from all this data and the rhetoric, coming out from the Fed’s officials, is that the central bank has already decided to move the rate up either in June or July, notwithstanding the presence of some troubling indicators. On the one hand, the June rate hike is more appropriate because it has a press conference and projection materials release attached to it. On the other hand, recent commentary by the Fed officials suggest that July hike would be more appropriate due to a lot of uncertainty that will be unwound only after June 15. I am inclined to support the latter. And what is your opinion on this matter?

What will FOMC decide on its June 2016 meeting?

- Keep interest rate the same (100%, 4 Votes)

- Increase interest rate (0%, 0 Votes)

- Decrease interest rate (0%, 0 Votes)

Total Voters: 4

![]() Loading …

Loading …

The poll will expire on June 15, at 17:00 GMT â one hour before the rate decision is announced.

If you have some idea of how the US Federal Open Market Committee will act during its next meeting and what will it be looking at to decide the future of the federal funds rate, please tell us using the commentary form below.