Three weeks ago, a representative from easyMarkets contacted me to ask if I would be interested to test their new intriguing feature called dealCancellation. They provided me with a free live account with $200 in it to explore this trading tool. This week, I have finally got some time to actually experience it.

Basically, dealCancellation is trade insurance. You pay in advance for an opportunity to cancel your entry within the next 60 minutes if you do not like how the position turned out for some reason. If the position is in a loss, it does not affect your balance.

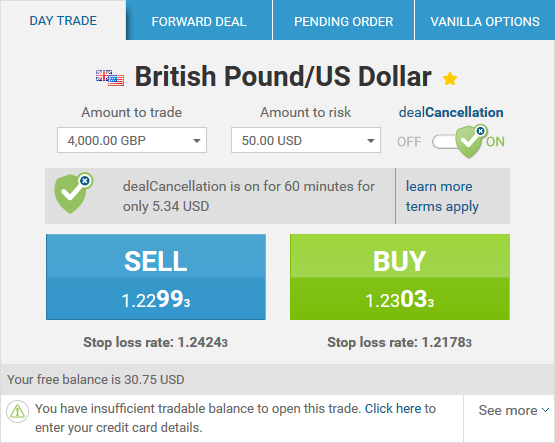

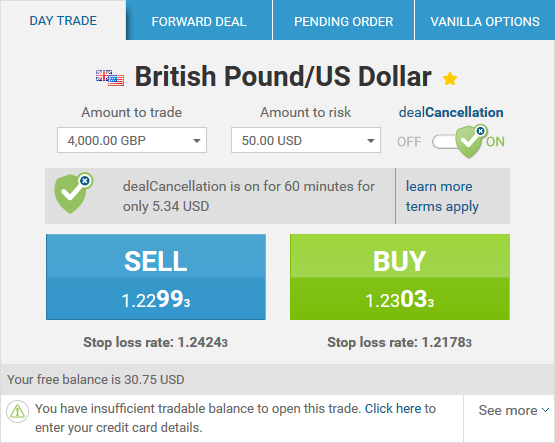

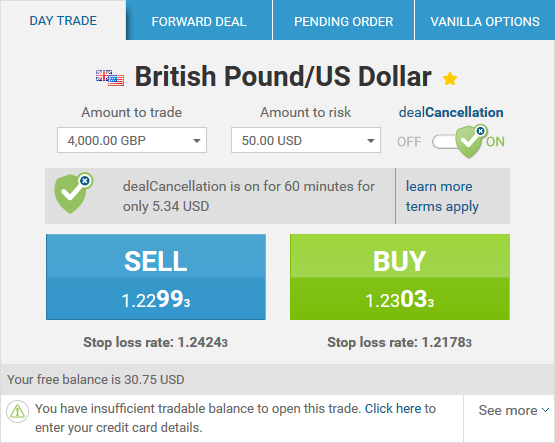

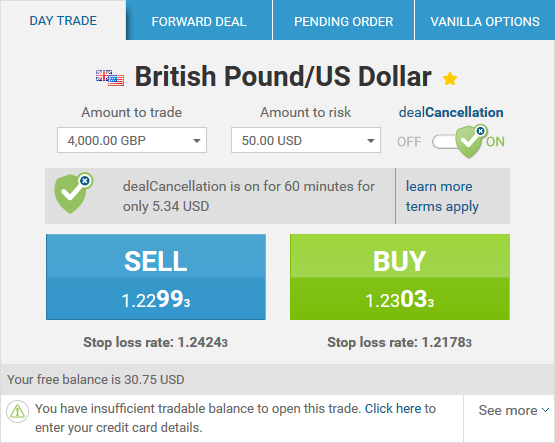

Using dealCancellation is quite straightforward, but the trading platform’s interface could be clearer about how it works and how the price of insurance is calculated. Here is how it looked for GBP/USD:

And here is the same for S&P500:

The price of dealCancellation depends on the position size and is not affected by the trade’s

When dealCancellation is active on a trade, its Close button shows a crossed out loss amount. It means that closing the trade now will incur no loss:

The insurance lasts only 60 minutes and you will start seeing a warning notification 10 minutes before it expires:

When dealCancellation expires, the loss is no longer crossed out. Closing the trade now will hit the account balance:

So, how useful dealCancellation is? In my opinion, while paying for 60-minute trade insurance is not a good idea when trading

Basically, when buying dealCancellation you are betting on high volatility of the currency pair (or CFD) during the next hour. For a trader who holds his trades for days and weeks, it does not make much sense. For an intraday trader with average duration in minutes, it can be viable. Overall, it is a nice risk protection mechanism to have in one’s inventory.

By the way, while testing the dealCancellation tool, I have noticed Inside View — a sentiment analysis tool. easyMarkets provides information based on the number of its customers going long or short on a given trading instrument. For example, for AUD/CAD it looked like this:

It seems to be a good idea to trade contrary to this indicator — to buy when the majority is short and to sell when the majority is long. After all, average retail trader should mostly be wrong in his judgement of the market. Of course, the higher is the percentage value in the Inside View the better because it suggests a stronger sentiment.

If you have any questions about this new feature from easyMarkets or if you have tried it and wish to share your opinion, please use the commentary form below.