- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 25, 2016

October 25

October 252016

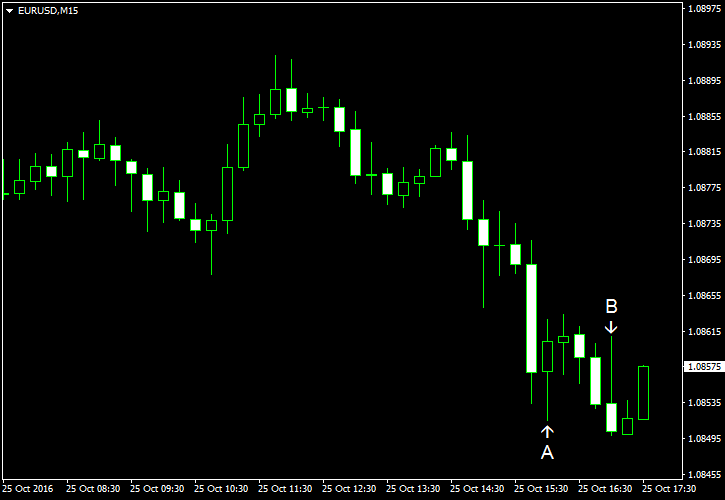

EUR/USD Resumes Decline, Ignoring Macroeconomic Data

EUR/USD resumed its declined today after staying flat yesterday. The currency pair also traded sideways at the start of the current session, but has started a decline at 12:00 GMT and is moving down currently. Economic data from the eurozone (namely, from Germany) was good while the US consumer confidence indicator was disappointing, but that had little impact of the performance of the pair. S&P/Case-Shiller home price index was […]

Read more October 25

October 252016

Improving German Business Climate Provides Limited Support to Euro

Yet again positive macroeconomic data from the eurozone provided limited support to the euro. The German business climate showed unexpected signs of improvement, yet the euro was mixed during the current trading session. The Ifo Business Climate Index rose from 109.5 in September to 110.5 in October. Market participants were surprised by the improvement as analysts had predicted the indicator to stay virtually unchanged. Yet the surprisingly good data failed to boost the eurozone […]

Read more October 25

October 252016

Improving German Business Climate Provides Limited Support to Euro

Yet again positive macroeconomic data from the eurozone provided limited support to the euro. The German business climate showed unexpected signs of improvement, yet the euro was mixed during the current trading session. The Ifo Business Climate Index rose from 109.5 in September to 110.5 in October. Market participants were surprised by the improvement as analysts had predicted the indicator to stay virtually unchanged. Yet the surprisingly good data failed to boost the eurozone […]

Read more October 25

October 252016

Swiss Franc Falls as SNB Monetary Easing Has Not Reached Limit

The Swiss franc fell today as policy makers of the Swiss National Bank were defending the current negative interest rates and signaled that monetary easing has not yet reached its limit. Yesterday, SNB Chairman Thomas Jordan defended the low rates, saying: Despite these monetary policy challenges and potential side-effects, in Switzerland the negative interest rate is currently indispensable, owing to the overvaluation of the Swiss franc and the globally low […]

Read more October 25

October 252016

Swiss Franc Falls as SNB Monetary Easing Has Not Reached Limit

The Swiss franc fell today as policy makers of the Swiss National Bank were defending the current negative interest rates and signaled that monetary easing has not yet reached its limit. Yesterday, SNB Chairman Thomas Jordan defended the low rates, saying: Despite these monetary policy challenges and potential side-effects, in Switzerland the negative interest rate is currently indispensable, owing to the overvaluation of the Swiss franc and the globally low […]

Read more