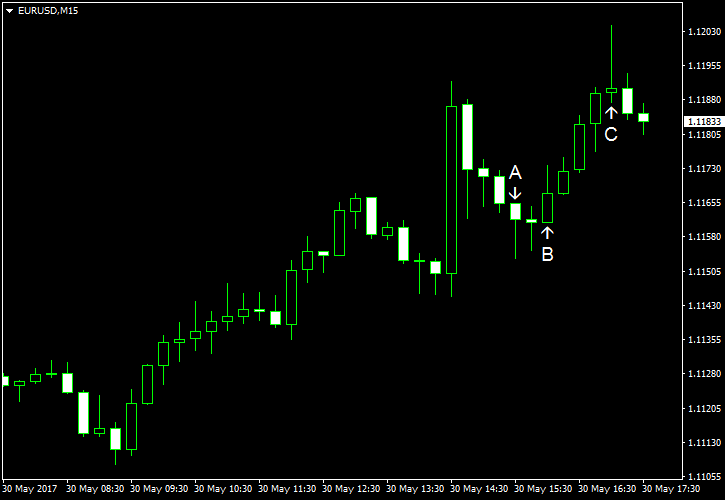

EUR/USD rebounded today after falling intraday even though eurozone macroeconomic data was less than impressive. US economic reports, on the other hand, were decent, with the exception of the consumer sentiment that worsened unexpectedly. One of the possible reasons for the rally of the currency pair were speculations that the European Central Bank may discuss removal of monetary stimulus at the June policy meeting.

Both personal income and spending rose 0.4% in April, matching forecasts exactly. Income was up 0.2% in March, while spending increased 0.3% (revised from no change in the prior estimate). (Event A on the chart.)

S&P/

Consumer confidence decreased to 117.9 in May from downwardly revised 119.4 in April (120.3 before the revision) instead of rising to 120.1 as experts had predicted. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.