The last time the US Federal Reserve had raised its target interest rate in June this year it went up from the range of 0.75–1.00% to 1.00–1.25%. Will there be another interest rate increase in 2017? Let’s try to figure it out.

Contents

- 1 Sentiment

- 2 Data

- 3 Balance Sheet Normalization

- 4 Words

- 5 Future

- 6 My opinion

- 7 Poll

Sentiment

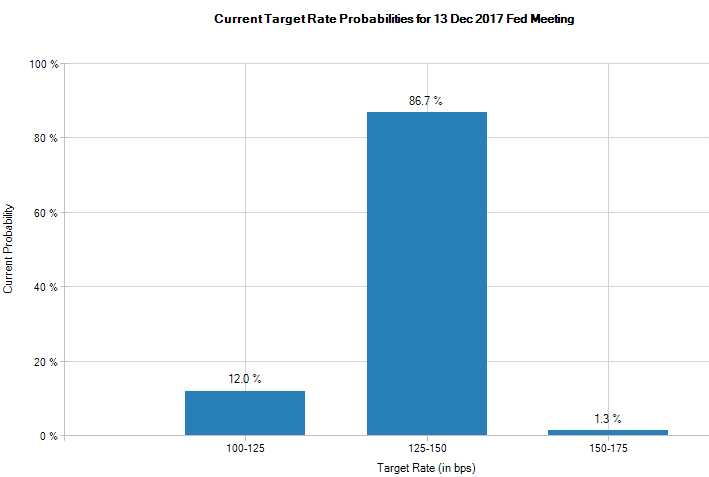

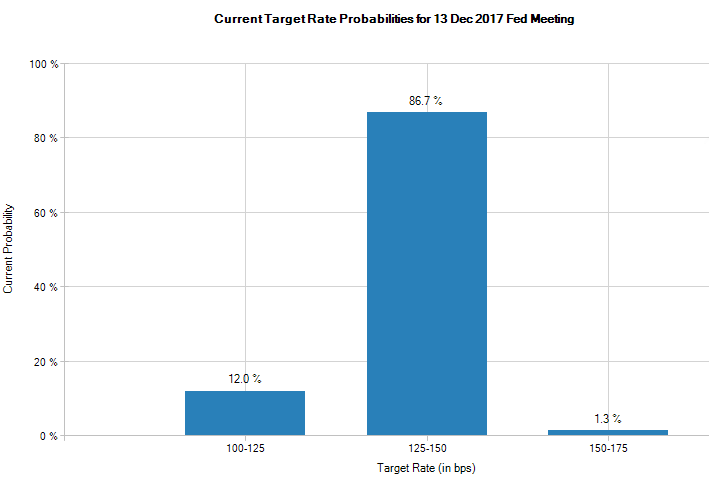

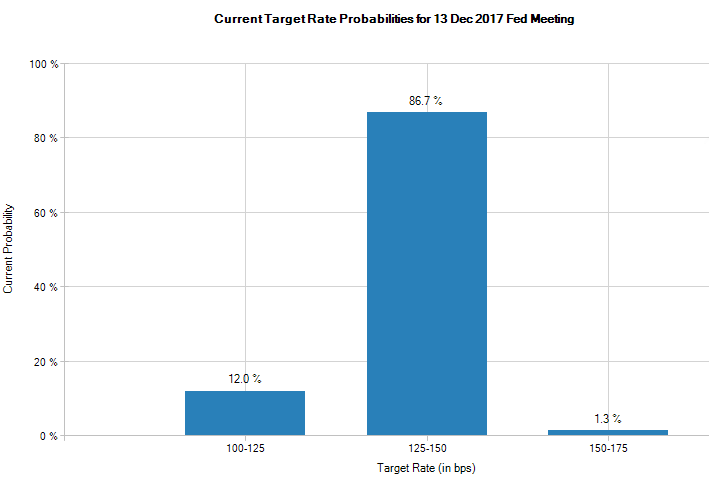

It is the current consensus that the probability of an interest rate hike during the FOMC’s November 1 meeting is negligible (1.5% according to CME FedWatch Tool). On the other hand, the December 13 interest rates decision looks to be accepted for granted according to the market sentiment — traders expect a rate hike; some of them even believe in a 50 basis points increase — to 1.50–1.75% target range.

There was a sharp uptake in the expectations in September. First, spurred by the September 20 meeting’s statement and projection materials. Then, by the September 26 speech Inflation, Uncertainty, and Monetary Policy delivered by the Fed’s Chair Janet Yellen at the 59th Annual Meeting of the National Association for Business Economics in Cleveland, Ohio. And then again, by the US employment report released on October 6.

Economists surveyed by the Wall Street Journal in September assign 76.8% probability to the rate hike this December.

Data

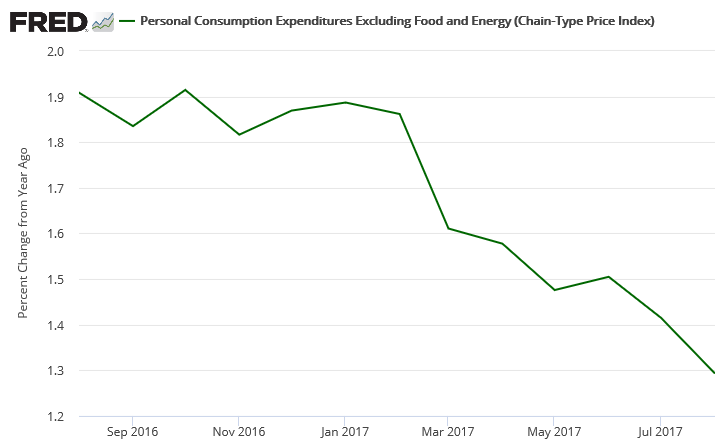

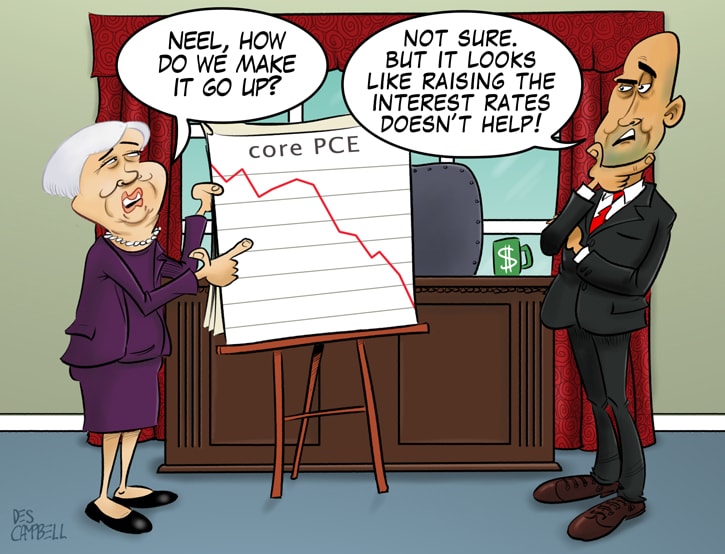

If we turn to the macroeconomic data for our analysis of the current situation, the picture turns rather dovish.

The

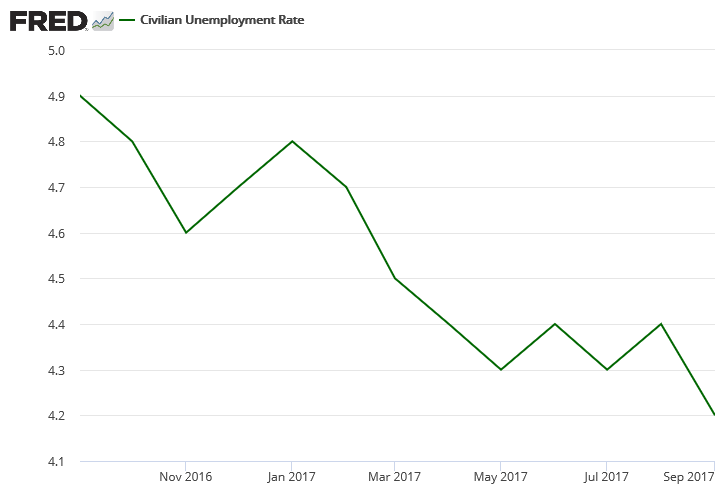

The US unemployment rate for the last 12 months is plotted below. It shows a steady decline to 4.2–4.4% range, which suggests that the maximum employment level has been finally reached.

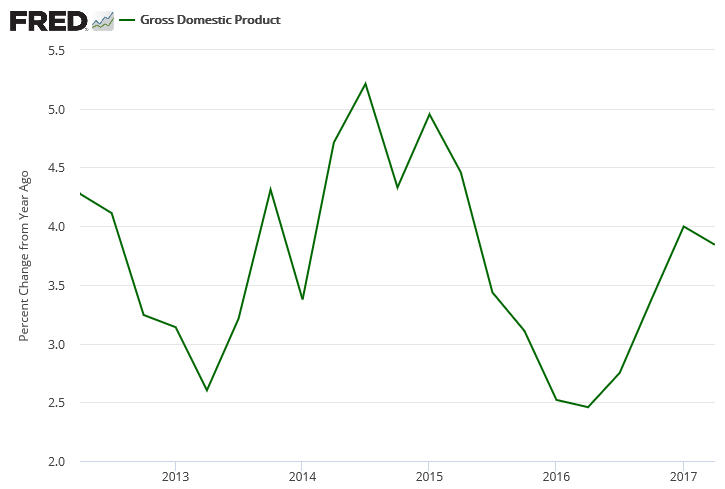

What we see on this 5-year chart of quarterly GDP growth rates is not bad at all. The economic output is rising at a steady level with no quarter below 2.5% rate, which would be considered fantastic in many other developed nations.

Balance Sheet Normalization

One new important factor related to the central bank’s monetary policy and the US dollar strength is the normalization of the Fed’s balance sheet. Starting October the Fed will begin shrinking its enormous balance sheet ($4.5 trillion). However, the pace of normalization will be very slow — about 0.2% per month. This ensures gradual transition to a smaller balance with a lot of wiggle room and a possibility to roll the reduction back without too much effort.

Overall, this is a positive development for the strength of the US currency but has a minor (really, tiny) negative effect on inflation. In theory, this could further impede the Fed’s ability to increase the interest rates. However, I would not expect any effect at all. It is just good to keep in mind where the general trend in the Fed’s monetary policy is heading.

Words

The

…without further modest increases in the federal funds rate over time, there is a risk that the labor market could eventually become overheated, potentially creating an inflationary problem down the road that might be difficult to overcome without triggering a recession. Persistently easy monetary policy might also eventually lead to increased leverage and other developments, with adverse implications for financial stability. For these reasons, and given that monetary policy affects economic activity and inflation with a substantial lag, it would be imprudent to keep monetary policy on hold until inflation is back to 2 percent.

Fed Governor Lael Brainard was much more cautious speaking about further rate hikes on September 5:

I will be looking closely at the evolution of inflation before making a determination about further adjustments to the federal funds rate. We have been falling short of our inflation objective not just in the past year, but over a longer period as well. My own view is that we should be cautious about tightening policy further until we are confident inflation is on track to achieve our target.

Further communication from the key figures at the FOMC will provide more insight on the probability of the the rate increase in December.

Future

Before December FOMC meeting, we will have quite a lot of macroeconomic data releases in the United States. There will be two monthly employment reports — on November 3 and on December 8. And two more reports on GDP growth: October 27 — an advance report for the third quarter and then on November 29 — a preliminary (aka second estimate) for the same quarter. PCE inflation numbers will also be updated twice: on October 30 and on November 30.

As for the Q3 GDP data, we (and the Fed) already have the nowcasts (forecasts based on the available economic statistics) published by three Federal Reserve Banks. Here are their predictions for the third quarter of 2017:

In addition, we have expert survey forecasts prepared by the Federal Reserve Bank of Philadelphia on August 11 (yeah, rather stale) with 2.6% and by the Wall Street Journal in September with 2.7% figure.

Perhaps, not less important than the economic data, the FOMC meeting minutes and statements will be able to change the markets’ perception of the December rate hike probability. September meeting’s minutes will be released very soon — on October 11 and might shed more light on what way of thinking dominates among the committee’s members. November 1 meeting statement will offer an update on the Fed’s vision of the US economy and its monetary policy. Then on November 22, we will be able to learn more details from that meeting’s minutes.

Update 2017-10-12: The FOMC September meeting minutes, which have been released yesterday, did cause some stirring in the currency markets, but the fed funds rate probabilities for December remained unchanged. The minutes confirmed a division among the FOMC members on the issue of the transitory nature of the current low levels of price inflation.

Update 2017-10-27: The Q3 GDP data released today turned out to be excellent — a growth of 3.0%, further strengthening the case for the interest rate hike.

Update 2017-10-30: September PCE data failed to provide much

Update 2017-11-03: The FOMC meeting statement released on November 1 was a complete nonevent for the currency market as nothing new has been revealed about the Fed’s intentions. The October employment statistics was a mixed bag but did not disappoint dollar bulls in their hawkish rate expectations.

Update 2017-11-22: The minutes of the November meeting have emphasized the divide among the Fed’s policymakers. On the one hand, the minutes suggest that at least one rate increase is warranted in the

Update 2017-11-30: October PCE data was not stellar. Although, the September monthly reading has been revised positively from 0.1% to 0.2%, the October growth by 0.2% failed to exceed the forecast value. The yearly change of 1.4% does not support the case for a rate increase.

Update 2017-12-08: The US employment report came out more or less positive, with stable growth of private jobs and no change to the unemployment rate while hourly earnings failed to meet expectations. Overall, this report had not significant impact on the rate hike forecasts.

My opinion

Do I believe that the FOMC should raise the rates? No. Do I expect them to do it? Yes, definitely. There is one thing central bankers hate to do — disappointing the markets and then having to deal with a tantrum. Besides, it looks more and more as if Yellen considers 2% inflation as some sort of a cap for inflation rather than a target, afraid to overshoot it but not minding much when it is undershot.

Poll

And what do you expect of the FOMC’s likelihood to raise the interest rate one more time this year?

What will FOMC decide on its December 2017 meeting?

- Increase interest rate. (53%, 8 Votes)

- Keep interest rate unchanged. (47%, 7 Votes)

- Decrease interest rate. (0%, 0 Votes)

Total Voters: 15

![]() Loading …

Loading …

The poll will expire on December 13 at 17:00 GMT â one hour before the rate decision is announced.

Update 2017-12-13: As was widely expected, the FOMC has raised the interest rate to 1.25–1.50 range at its December 2017 meeting.

If you have a detailed view on how the US Federal Open Market Committee is going to act during its December 12â13 meeting and what will they be looking at to decide the future of the federal funds rate, please share your thoughts using the commentary form below.