EUR/USD traded almost flat on Tuesday as the Federal Open Market Committee started its

S&P/

Chicago PMI climbed from 65.2 in September to 66.2 in October instead of dropping to 60.2 as analysts had predicted.

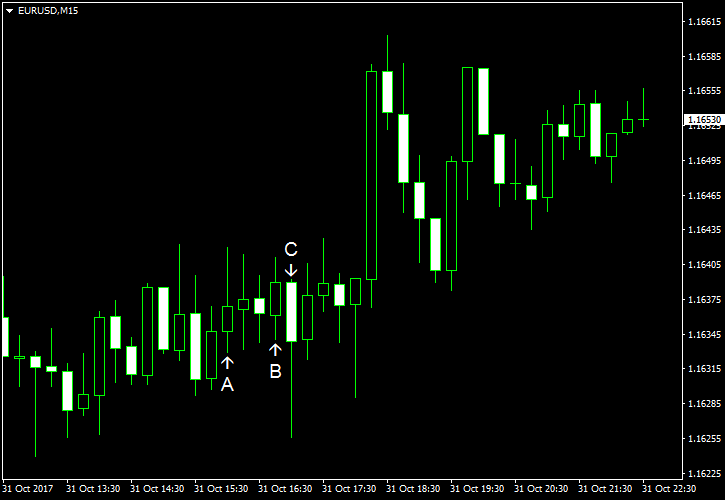

Consumer confidence jumped from 120.6 in September (upwardly revised from 119.8) to 125.9 in October, far above the forecast value of 121.1. (Event B on the chart.)

Yesterday, a report on personal income and spending was released, showing that both indicators rose in September. Income was up 0.4%, exactly as analysts had predicted, after rising 0.2% in August. Spending increased by 0.8%, compared to the medium forecast of 0.8% and the previous month’s increase of 0.1%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.