Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA -0.1%, Nasdaq 100 +0.3%, S&P 500 -0.1%

Major Headlines

- Chinese Caixin Manufacturing PMI beat expectations at 51.1

- NZ Q1 Employment Change grew 0.6%, Unemployment Rate fell to 4.4%

- Eurozone GDP slowed to 2.5% from 2.7%, Unemployment Rate remains at 10yr low

- UK Construction PMI moves back into expansionary territory at 52.5 from 47.0

- US ADP Employment Change 204k vs. Exp. 200k

- API Crude Inventory Report showed a larger than expected build of 3.427mln bpd

- Apple up over 5% after EPS beat and USD 100bln share buyback

- Looking ahead, FOMC meeting and DoE Crude Oil Report

USD: Gains in the US Dollar have come to a halt this morning with the USD basket marginally lower as investors eye the FOMC meeting later. Expectations of a more hawkish Federal Reserve had underpinned the gains in the greenback and attributed to the recent recovery in the greenback. Today’s FOMC meeting may well largely be a non-event given that there will be no press conference from Powell or any dot plot projections, the Fed Funds Rate will almost definitely be left unchanged. As such, focus will be on the accompanying statement, however, USD bulls may be left a tad disappointed with the FOMC possibly only providing a slight hawkish tilt in language in regard to inflation given the building price pressures but the Fed will largely stick to a steady approach in order to not stoke too much market volatility. Elsewhere, the US ADP Employment report beat expectations at 204k (Exp. 200k), maintaining the picture of strong job growth with little sign of a slowdown.

EUR: Unsurprisingly, Euro-Area growth moderated slightly in the first quarter of 2018 to 2.5% from 2.7%. The Euro saw a muted reaction given that the figures had printed in line with expectations, additionally, growth remains robust and will unlikely deter the ECB from its exit strategy with the next policy shift potentially being announced at the June/July meeting. The Q/Q reading fell to 0.4%, which was below the ECB’s 0.7% forecast for Q1, which may in turn lead to a downgrade in the ECB growth staff projections (released at the June meeting). Tomorrow’s inflation report will be in focus, whereby risks are tilted to the downside after a slowing in Germany’s price growth seen at the beginning of the week. 1.2000 is keeping EURUSD price action rather static for now, to the downside near-term support is situated at 1.1915 (Jan 9th low), while on the topside, 1.2015 represents the 200DMA.

GBP: Sterling has seen a mild reprieve this morning with support just under 1.3600, while also receiving a lift by the rise in UK Construction PMI, which printed ahead of expectations. More importantly, Construction PMI moved back into expansionary territory at 52.5 from the dire reading of 47 in March. However, this will unlikely be enough to provide stability for GBP, given last week’s poor Q1 growth report, which also came off the back of softer inflation. Alongside this, Brexit concerns have also been rising as the EU mounts the pressure on the UK to provide a workable solution for the Irish border. As such, this will likely keep a lid on Pound gains for now.

NZD: The 0.7000 level continuing to keep NZDUSD supported for now, overnight saw the release of a relatively mixed jobs report. Wage growth remained sluggish at 0.3%, underwhelming expectations of 0.4%, while the unemployment rate showed a surprise fall to the lowest level since Q4 2008 at 4.4%. This ultimately emphasizes the case that the RBNZ will likely be on hold for the foreseeable future.

DailyFX Economic Calendar: Wednesday, May 2, 2018 – North American Releases

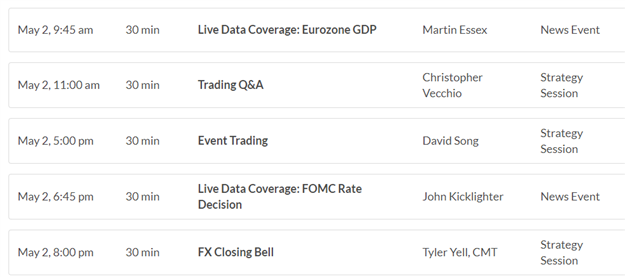

DailyFX Webinar Calendar: Wednesday, May 2, 2018

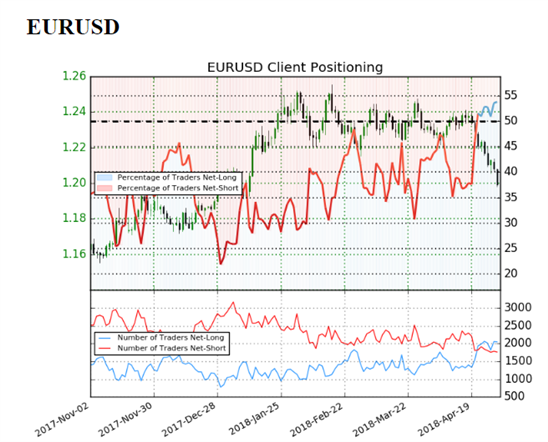

IG Client Sentiment Index Chart of the Day: EURUSD

IG Market Positioning Suggests EURUSD Outlook is Bearish

EURUSD: Data shows 53.8% of traders are net-long with the ratio of traders long to short at 1.16 to 1. The number of traders net-long is 2.6% lower than yesterday and 0.3% higher from last week, while the number of traders net-short is 6.7% lower than yesterday and 11.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Four Things Traders are Reading

- “US Dollar Outlook for the May FOMC Meeting” by Christopher Vecchio, SeniorCurrency Strategist

- “Brexit Concerns Add to GBP Weakness Ahead of UK/EU Talks” by Martin Essex, MSTA, Analyst and Editor

- “Euro Sees Muted Response to Slowing Euro-Area Growth; Eyes on Inflation” by Justin McQueen, Market Analyst

- “Crude Oil, Gold Prices May Rise as the FOMC Cools Hawkish Excess” by Ilya Spivak, Senior Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX