- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 3, 2018

May 3

May 32018

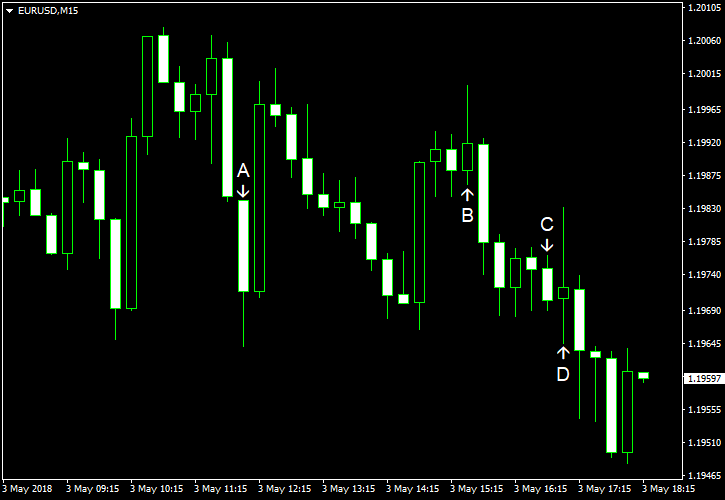

EUR/USD Attempts to Rally on Profit-Taking, Fails

EUR/USD attempted to rally today as the dollar seemed rather soft due to profit-taking that followed the greenback’s strong performance yesterday. Yet the rally failed, and the currency pair is trading near the opening level right now. Macroeconomic data was not beneficial to the currency pair as eurozone inflation slowed unexpectedly (event A on the chart), while US reports were good for the most part. Nonfarm productivity rose 0.7% in Q1 2018. That […]

Read more May 3

May 32018

Canadian Dollar Mixed amid Clashing Fundamentals

The Canadian dollar was mixed today, rising against some currencies and falling versus others. The possible reason for that were clashing fundamentals, which did not provide a clear direction to the loonie. Statistics Canada reported that the trade balance deficit widened from C$2.9 billion in February to C$4.1 billion in March. That is instead of shrinking to C$2.3 billion as economists had predicted. Looking deeper into the report, the situation did […]

Read more May 3

May 32018

US Dollar Stays Volatile as Traders Speculate About Fed Policy

The US dollar remained extremely volatile following yesterday’s Federal Reserve meeting. The currency was soft at start of today’s session but attempted to rally later. As a result, the greenback was mixed today. The Fed kept the target range for the federal funds rate at 1.5% to 1.75% as was expected by basically everyone. Some analysts pointed at the word “symmetric” that described inflation goal, interpreting them as a sign that the Fed can tolerate overshooting […]

Read more May 3

May 32018

Slowing UK Economy Weighs on GBPUSD Outlook

GBPUSD Analysis and News PMI surveys point to 0.2% growth in Q2, marking the second weakest since the Brexit vote Weak economy and Brexit uncertainty reign in expectations of a BoE interest rate hike Poor UK PMI Data Takes May Rate Rise Firmly Off the Table Today’s UK Service PMI rounded up what has been […]

Read more May 3

May 32018

US AM Digest: EURUSD gives up 1.20 Base After Euro-Area Inflations Dips

Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here US Market Snapshot via IG: DJIA -0.6%, Nasdaq 100 -0.5%, S&P 500 -0.5% Major Headlines Eurozone Inflation slows in April; Core CPI falls to 0.7% UK Service PMI rebounds, however misses expectations US Trade Deficit Narrows […]

Read more May 3

May 32018

EUR/USD Attempts to Rally on Profit-Taking, Fails

EUR/USD attempted to rally today as the dollar seemed rather soft due to profit-taking that followed the greenback’s strong performance yesterday. Yet the rally failed, and the currency pair is trading near the opening level right now. Macroeconomic data was not beneficial to the currency pair as eurozone inflation slowed unexpectedly (event A on the chart), while US reports were good for the most part. Nonfarm productivity rose 0.7% in Q1 2018. That […]

Read more May 3

May 32018

Sterling Pound Falls on Weak UK Services PMI Data

The Sterling pound today declined slightly against the US dollar following the release of the weak Markit/CIPS UK Services PMI data in the early European session. The pound was minimally affected in the early American session after several releases from the US docket such as the positive jobless claims data. The GBP/USD currency traded mostly in a range today as bulls battled the bears for control with neither side emerging as the winner. The cable was stuck […]

Read more May 3

May 32018

Euro Posts Slight Decline on Disappointing Eurozone CPI Data

The euro today registered a slight decline against the US dollar following the release of the Eurozone Consumer Price Index data in the early European session. The EUR/USD currency pair began today’s session in positive territory and had rallied to highs above 1.2000 before trimming some of its gains after the CPI release. The EUR/USD currency pair today declined from a high of 1.2010 to a low of 1.1965, but was still higher for the day having […]

Read more May 3

May 32018

Asian Stocks Mixed As Markets Mull Fed Call, US Payrolls Loom

ASIAN STOCKS TALKING POINTS: Asian markets were mixed, with Tokyo out for holiday The US Federal Reserve left rates alone but may not do so in June The US Dollar looked a little listless Find out what the #1 mistake that traders make is so that you never have to join them! Asian stocks were […]

Read more May 3

May 32018

USD Edges Lower as Traders Turn Attention to China Trade Talks

USD talking points: – With the Federal Reserve meeting now out of the way, the markets’ focus is turning to the US/China trade negotiations. – That has left the US Dollar marginally lower, although it remains in a strong uptrend. Check out the IG Client Sentiment data to help you trade profitably. And for a […]

Read more