- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 4, 2018

May 4

May 42018

US Dollar Retains Strength After Disappointing Nonfarm Payrolls

The US dollar showed relatively solid performance today, considering that the major economic release, nonfarm payrolls, came out rather disappointing. The headline figure came out below expectations at 164,000 versus forecasts of 190,000. Wage inflation remained stable at 0.2%, while analysts had expected it to accelerate a bit to 0.3%. The unemployment rate was the only part of report that turned out to be better than expected, falling […]

Read more May 4

May 42018

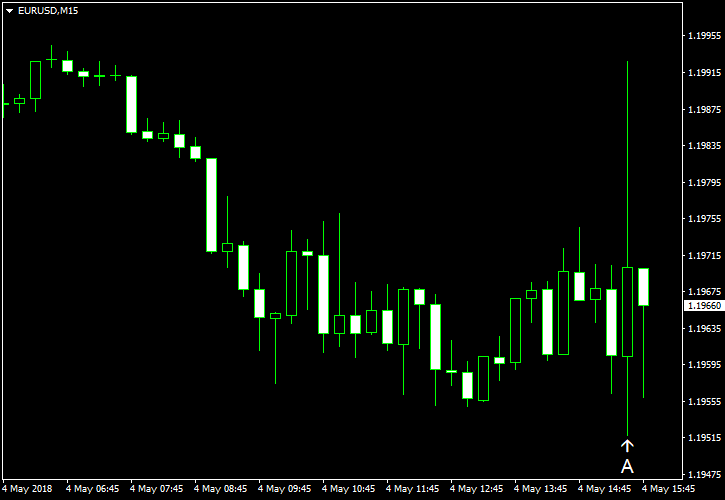

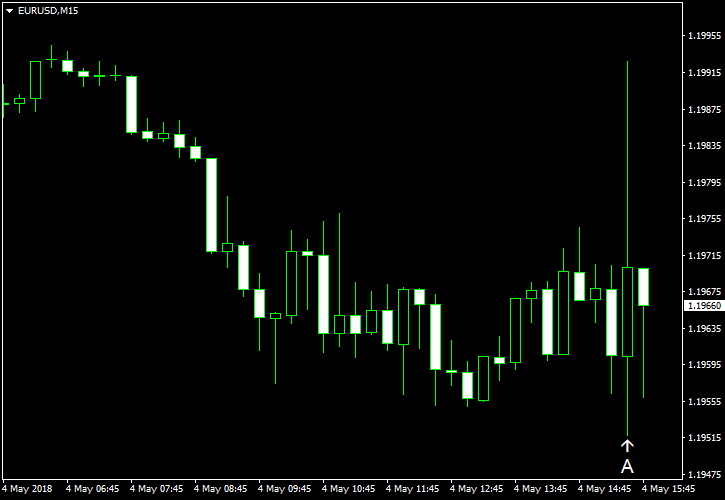

Euro Declines on Weak Eurozone PMI Releases Amid Poor NFP Data

The euro today was on a downtrend against the US dollar following the release of weak PMI data from across the Eurozone by IHS Markit. The euro’s downtrend was further accelerated by the release of disappointing Eurozone retail sales data for March in the early European session. The EUR/USD currency pair today lost over 80 points to decline from a high of 1.1995 to a low of 1.1910. The currency pair was on a downtrend from the late Asian session and the release […]

Read more May 4

May 42018

US AM Digest: NFP and Wage Miss Met With Lowest Unemployment Rate Since December 2000

Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here US Market Snapshot via IG: DJIA -0.4%, Nasdaq 100 -0.3%, S&P 500 -0.3% Major Headlines US NFP fell short of expectations at 164k vs. Exp. 192k, wages slow and unemployment rate falls to lowest since December […]

Read more May 4

May 42018

EUR/USD Fails to Rally on Disappointing Nonfarm Payrolls

US nonfarm payrolls came out surprisingly weak, prompting EUR/USD to jump immediately after the release. But the rally was extremely short-lived, and the currency pair is still hanging below the opening level right now. Nonfarm payroll employment increased by 164k in April, failing to meet the consensus forecast of a 190k increase. The March gain got a positive revision from 103k to 135k. Average hourly earnings rose by just 0.1%, also […]

Read more May 4

May 42018

EUR/USD Fails to Rally on Disappointing Nonfarm Payrolls

US nonfarm payrolls came out surprisingly weak, prompting EUR/USD to jump immediately after the release. But the rally was extremely short-lived, and the currency pair is still hanging below the opening level right now. Nonfarm payroll employment increased by 164k in April, failing to meet the consensus forecast of a 190k increase. The March gain got a positive revision from 103k to 135k. Average hourly earnings rose by just 0.1%, also […]

Read more May 4

May 42018

Asian Stocks Wilt Broadly As Investors Eye Trade Talks, US Payrolls

ASIAN STOCKS TALKING POINTS Asian stocks fell across the board The wait for US payroll data usually limits progress each month The US Dollar steadied below its recent highs Find out what the #1 mistake that traders make is so that you never have to join them! Asian markets were broadly weaker Friday as investors […]

Read more May 4

May 42018

Eurozone PMI Confirms Cooling Growth; EURUSD Weakness Set to Continue

EURUSD Analysis and Talking Points Eurozone PMI confirms that the Euro-Area growth is slowing down EURUSD unfazed as this is unlikely to have large ramifications on ECB policy, focus on inflation See our Q2 EUR forecast to learn what will drive the currency through the quarter. Eurozone PMI Maintains Narrative of Euro-Area Growth Levelling Off […]

Read more May 4

May 42018

DXY Little Changed After Mixed US NFP Report

NFP Analysis and Talking Points US Nonfarm Payrolls rose by 164k in April, missing expectations of 192k expected; Prior month revised to 135k from 103k. US Average Hourly Earnings pace slowed to 2.6% Y/Y and 0.1%, underperforming expectations of 2.7% and 0.2% respectively. US Unemployment Rate fell to 3.9%, lowest level since December 2000 NFP […]

Read more May 4

May 42018

Aussie Rallies on RBA Statement & China’s Data, Unable to Keep Gains

The Australian dollar rallied intraday, lifted by the optimistic outlook for the nation’s economy and positive macroeconomic data from China. Yet the currency was unable to preserve gains, falling to the opening level against some rivals and below it against others by now. The Reserve Bank of Australia released its Statement on Monetary Policy today. The outlook for the Australian economy, expressed by the central bank, was rather optimistic, though the RBA voiced concern about increasing […]

Read more May 4

May 42018

Asia AM Digest: AUD/USD Looks to RBA, Philippine Peso to CPI

To get the Asia AM Digest every day, SIGN UP HERE A Look Ahead – RBA Statement on Monetary Policy, Philippine Inflation During Friday’s Asian session, we will get the RBA’s statement on monetary policy and Caixin China Composite and Services PMIs. The former will offer a fresh set of inflation projections which may give […]

Read more