To get the Asia AM Digest every day, SIGN UP HERE

A Look Ahead – AU Retail Sales, NZ 2-Year Inflation Expectations

During Tuesday’s Asia session, we will get Australian retail sales figures. Growth here is expected to slow which could undermine the Australian Dollar in the near-term. However, with the RBA patient on monetary policy adjustments as is, the currency may regain some traction in the aftermath.

Then, the RBNZ’s 2-year inflation expectations survey will cross the wires. While the data will not represent the views of the central bank, it can give an idea of what consumers and businesses expect. If prices are anticipated to rise in the future, they may demand a higher return for compensation. Do keep in mind that the data will be released before Wednesday’s RBNZ rate decision which as a result may suppress NZD/USD’s reaction.

Current Market Developments – Crude Oil Prices Decline

Crude oil prices dived towards the end of Monday’s session as US President Donald Trump announced that he will make a decision on Iran on Tuesday around 18:00 GMT. Reports also crossed the wires that European diplomats were close to persuading the president not to withdraw from the Iran nuclear accord. Lately, the commodity has been climbing on bets that the US pulling out of the deal could disrupt supply chains. Some of those fears appeared to abate as oil fell.

Prior Session Recap – USD Déjà Vu

The US Dollar put in a similar performance on Monday as it did on Friday. First, the greenback appreciated during the first half of the day before tapering off by the second half. It did finish cautiously higher in the end. Thanks to its weakness during the latter half, other currencies appreciated at the expense of it. In particular, the British Pound shined the most with GBP/USD rebounding on a long-term trend line from April 2017.

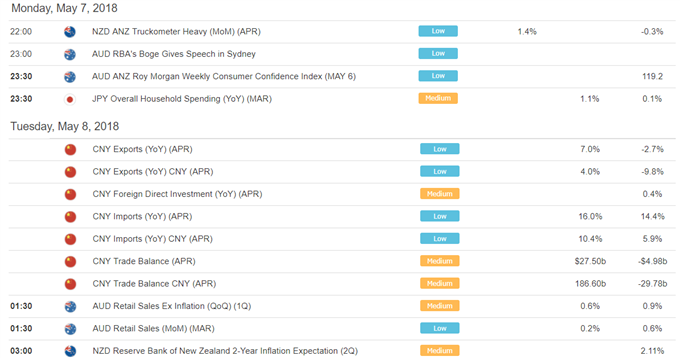

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

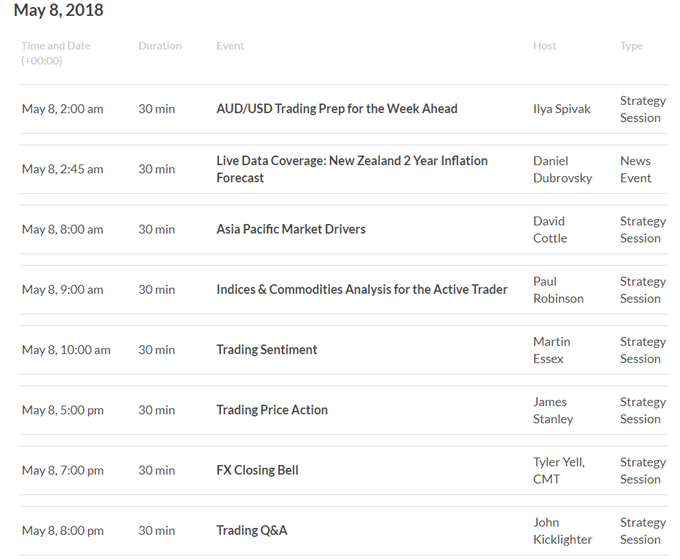

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

![]()

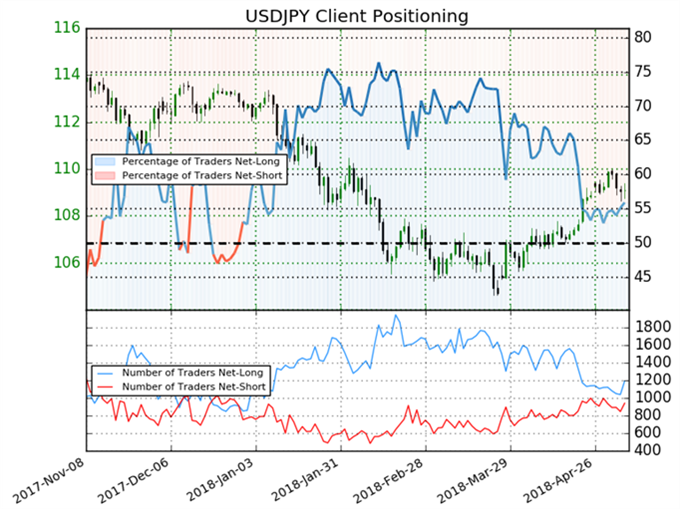

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 55.9% of USD/JPY traders are net-long with the ratio of traders long to short at 1.27 to 1. In fact, traders have remained net-long since Dec 29 when USD/JPY traded near 112.306; price has moved 2.9% lower since then. The number of traders net-long is 11.1% higher than yesterday and 0.7% higher from last week, while the number of traders net-short is 6.2% higher than yesterday and 5.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.

![]()

![]()

![]()

Five Things Traders are Reading:

- Canadian Dollar Rate Forecast: Light Pricing of BoC Hike Gives Upside by Tyler Yell, CMT, Forex Trading Instructor

- Slowing Australia Retail Sales to Keep AUD/USD Rate Under Pressure by David Song, Currency Analyst

- GBP/USD: Oversold Cable Tests Key Support Ahead of BoE Super Thursday by James Stanley, Currency Strategist

- GBP/JPY Bounces From Fibonacci Support: Is the Pain Trade Complete?by James Stanley, Currency Strategist

- Crude Oil Prices to Stay Bid as Bullish Sequence Unfoldsby David Song, Currency Analyst

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

To receive Daniel‘s analysis directly via email, please SIGN UP HERE