Crude oil talking points:

– The price of Brent crude oil has slipped back from its highs but remains above the $75/barrel mark.

– Its underlying strength is based on concerns that if Trump pulls out of the nuclear deal with Iran it could disrupt oil supplies.

Check out the IG Client Sentiment data to help you trade profitably.

And for a longer-term outlook take a look at our Q2 forecast for oil prices.

Iran concerns boost oil prices

The price of Brent crude oil has eased back but remains above $75/barrel and close to its highest level since late 2014. That means positive sentiment towards the commodity remains intact amid concerns that if Donald Trump pulls out of the nuclear deal with Iran then oil supplies could be disrupted. The US President has said he will announce his decision at 1800 GMT Tuesday.

Brent Crude Oil Price Chart, Five-Minute Timeframe (May 7 – 8, 2018)

Politicians from France, Germany and the UK have all tried to persuade Trump not to pull out of the deal but so far he seems determined to do so. If he does, oil prices could rise further.

However, the price of US oil is looking less buoyant than Brent, the global benchmark, and has not managed to stay above $70.

US Crude Oil Price Chart, Five-Minute Timeframe (May 7 – 8, 2018)

Oil sentiment

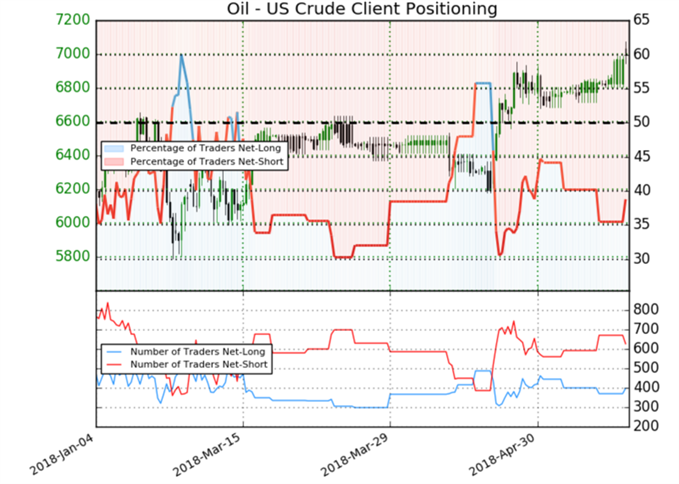

As for confidence, IG client sentiment data paint a mixed picture. Retail trader data show 38.8% of traders are net-long, with the ratio of traders short to long at 1.58 to 1. In fact, traders have remained net-short since April 9, when US crude traded near $63.12; the price has moved 10.8% higher since then. The number of traders net-long is 3.9% higher than yesterday and 14.3% lower from last week, while the number of traders net-short is 0.8% lower than yesterday and 1.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests US crude prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed US crude trading bias.

Resources to help you trade the forex markets

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance, and one specifically for those who are new to forex. You can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

— Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex