GBP Analysis and Talking Points

- GBPUSD rises following better than expected retail sales

- Recent Inflation figures sees BoE hike forecast pushed back

See our Q2 GBP forecast to learn what will drive the currency through the quarter.

GBP Supported as Retail Sales Rebound

GBPUSD pushed above 1.34 after news that UK retail sales saw a rebound in April, which had also beat expectations. The headline month/month figure rose 1.6% (Exp. 0.7%), while there was an increase of 1.3% in the core reading (excluding fuel). ONS stated that the bounce in retail sales was due to petrol sales, with a growth of 4.7%, having recovered from the prior months weather related effects. However, the ONS added that underlying position remains subdued with the volume of goods sold over the previous 6 months as broadly unchanged.

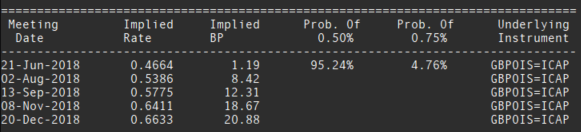

The better than expected figures have helped GBPUSD stabilise after yesterday saw the pair print fresh YTD lows at 1.3303, following the subdued inflation report, which had been the icing on the cake for GBPUSD bears. The continued easing in inflation (2.4% vs. Prev. 2.5%) reduces the necessity for the Bank of England to raise interest rates, which has been reflected in market pricing with OIS markets pricing in a 32% chance of an August rate hike, down from 40%, while a November rate hikes is seen at 74%.

Source: Thomson Reuters

GBPUSD CHART: 1-MINUTE TIME FRAME (INTRADAY MAY 24, 2018)

IG Sentiment Remains GBPUSD Bearish

Looking ahead, IG Client Sentiment data are currently sending a bearish signal for GBPUSD. For more information click here

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX