JPY Analysis and News

- JPY Supported by Safe Haven Flow

- EURJPY Falls to Lowest Level Since June 2017

For a more in-depth analysis on the Japanese Yen, check out the Q2 Forecast for JPY

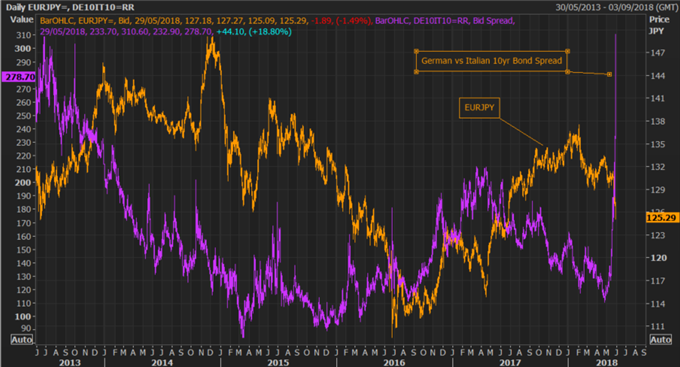

Italian Fears Spark JPY Demand vs EUR

As mentioned previously (click here) rising political tensions would see the Japanese Yen among the notable gainers. Uncertainty remains high in Italy, which is likely to be the case in the near term with Italy now heading towards another election later this year. As such, German-Italian spreads have widened considerably over the past week from 164bps to a high of 310bps, levels last seen during the Eurozone bond crisis. In effect this has weighed on the Euro and Italian assets, consequently pressuring EURJPY to the lowest level since June 2017.

According to IG Sentiment, EURJPY positioningsuggests that the pair may continue to fall, for more information of client positioning, click here

Source: Thomson Reuters

Spanish Uncertainty Lingering

Aside from Italy, Spain is beginning to enter the fray with the Spanish Parliament expected to vote on a no-confidence motion against PM Rajoy on Friday. A passing of no-confidence motion will likely see snap elections called in Spain which will add to the pressure on the Euro and force further buying interest in the JPY as investor sentiment will be unnerved by a wave of political uncertainty not only in Italy but also in Spain.

EURUSD Slumps as Italy Poses a Real EUR Risk by DailyFX Analyst Nick Cawley

EURJPY PRICE CHART: DAILY TIME FRAME (November 2015-May 2018)

Nearby support in the pair is not seen until 1.2350, which represents the 61.8% retracement of the 114.85-137.50 rise, while the lows from June 15th are seen at 1.2240. EURJPY Relative Strength Index is in oversold territory, the most since the French election, which could potentially hint a mild reversal. However, a step up in political uncertainty with Spain starting to cause concerns will likely to the selling persist.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX