- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 1, 2018

June 1

June 12018

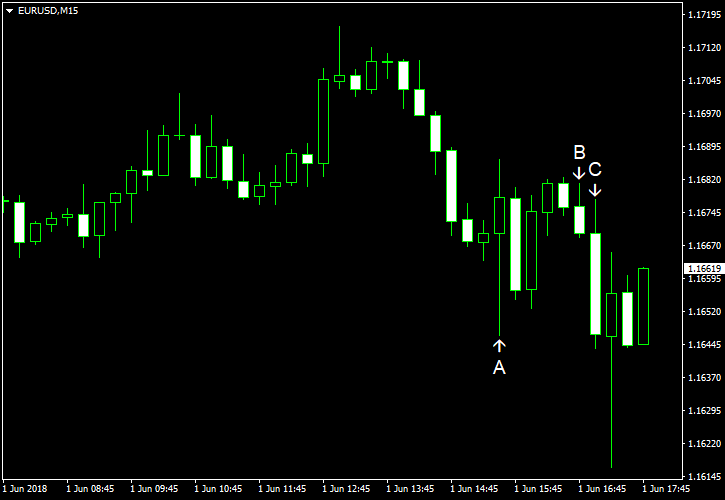

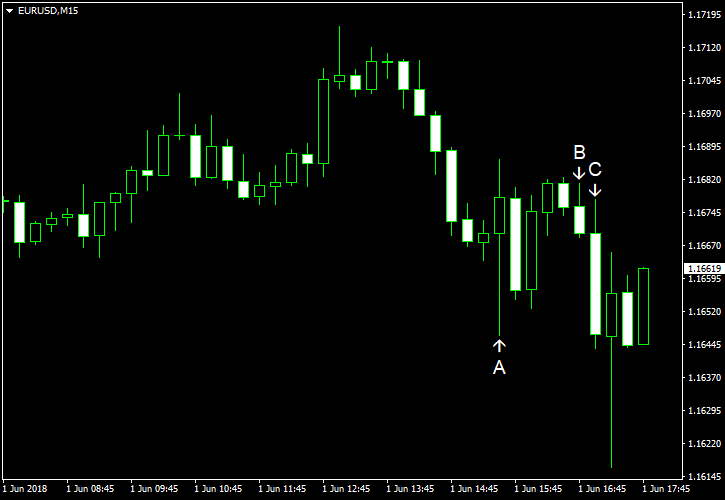

EUR/USD Rallies as Employment Data Exceeds Expectations

EUR/USD rallied today even though trade wars between the United States and their trading partners have started. Yet macroeconomic data in the United States overshadowed other news. Almost all indicators released today were very solid. The employment report drew the most attention from traders as basically all of its components were better than expected. Nonfarm payrolls rose by 223k in May, demonstrating a much faster rate […]

Read more June 1

June 12018

S&P 500, DAX & FTSE – Buyers Stepping In On Pullbacks, So Far

Talking Points: NFPs beat expectations on Friday, light calendar next week; S&P price action in limbo Light calendar ahead; response to DAX decline could be telling BoE BoE/TNS Inflation on Friday; FTSE being tested after failed breakout For the intermediate-term technical and fundamental outlook, check out the DailyFX Q2 Forecasts. S&P 500 On Friday, we […]

Read more June 1

June 12018

Technical Chart Analysis – Bitcoin, Ether, Ripple, Litecoin

News and Talking Points – Bitcoin, Ripple, Ether, Litecoin – Prices ending the week higher in low turnover. – If chart support levels hold, further gains may be on the cards. To see how retail traders are currently positioned in cryptocurrencies and what it means for the market looking forward, download the IG Client Sentimentpage. […]

Read more June 1

June 12018

Non-Farm Payrolls Lift US Dollar

The US dollar rallied against most major peers today after employment data showed better-than-expected readings for all major indicators. The Great Britain pound managed to outperform the greenback, though, thanks to the positive report about Britain’s manufacturing. Nonfarm payrolls showed a healthy growth of 223,000 in May, which was far bigger than 189,000 promised by economists. The unemployment rate unexpectedly fell by 0.1 percentage point to 3.8%. Average hourly […]

Read more June 1

June 12018

EUR/USD Rallies as Employment Data Exceeds Expectations

EUR/USD rallied today even though trade wars between the United States and their trading partners have started. Yet macroeconomic data in the United States overshadowed other news. Almost all indicators released today were very solid. The employment report drew the most attention from traders as basically all of its components were better than expected. Nonfarm payrolls rose by 223k in May, demonstrating a much faster rate […]

Read more June 1

June 12018

US Dollar Edges Higher as May US Jobs Report Mostly Beats

Talking Points: – Headline jobs growth comes in at +223K, while the net two-month revision was +15K. – US wage growth increases to+2.7% y/y asthe unemployment rate dropped to 3.8%, a new cycle low. – The US Dollar turned higher following the data, with the DXY Index rising from 94.16 to as high as 94.34, […]

Read more June 1

June 12018

GBPUSD Sees Limited Reaction as UK Manufacturing PMI Rebounds From 17-Month Low

GBPUSD Analysis and News UK Manufacturing PMI sees modest lift from 17-month lows, however underlying concerns remain. GBPUSD remains south of 1.33, GBP traders look for next week’s Construction and Services PMI Mild Uptick Masks Underlying Concerns UK Manufacturing PMI pointed to a limited pick up to 54.4 in May from 17-month lows of 53.9, […]

Read more June 1

June 12018

EURUSD: Italian Risk Remains, NFPs Loom

EURUSD News and Talking Points – Italian risk lowered but not removed. – EURUSD may weaken further on a strong US non-farm payroll print. The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are now availableto download to help you make more informed trading decisions. EURUSD Remains Under Pressure Italian financial markets […]

Read more June 1

June 12018

Sterling Gets Boost from Britain’s Improving Manufacturing

The Great Britain pound dipped at the start of the current trading session but halted its decline later and attempted to rally. The currency got additional boost from the better-than-expected manufacturing report. The seasonally adjusted IHS Markit/CIPS Manufacturing Purchasing Managers’ Index edged up to 54.4 in May from 53.9 in April. That is compared to a drop to 53.5 predicted by analysts. It is important to note, though, that the April’s reading was the lowest […]

Read more June 1

June 12018

Australian Dollar Lower amid Mixed Data, Trade Wars

The Australian dollar fell today amid mixed macroeconomic data released over the trading session in Australia and its major trading partner, China. Risk aversion caused by trade wars between the United States and their allies also hurt the currency. The Australian Industry Group Australian Performance of Manufacturing Index fell to 57.5 in May from 58.3 in April. The Index of Commodity Prices reported by the Reserve Bank of Australia rose 3.6% in May from […]

Read more