- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 5, 2018

June 5

June 52018

Canadian Dollar Drops on Trade War Fears, Falling Crude Oil

The Canadian dollar fell against its major rivals on Tuesday amid concerns about trade wars between the United States and their allies, Canada being one of them. The drop of crude oil added to the currency’s woes. The Canadian economy heavily depends on trade with the USA, therefore it is very important for Canada to preserve the North American Free Trade Agreement. Yet it looks like the NAFTA negotiations between the US, […]

Read more June 5

June 52018

US Dollar Soft as Trade War Fears Creep Up

The US dollar was rather soft due to concerns that potential trade wars between the United States and their allies can damage the US economy. Positive domestic macroeconomic data was unable to bolster the greenback. Mexico announced that it is going to put tariffs on US products in retaliation to the announcement of US import duties on metals. That should complicate NAFTA talks between the USA, Mexico, and Canada. Additionally, the Group […]

Read more June 5

June 52018

Asian Shares Trim Prior Gains, AUD/USD At Pivotal Point Post RBA

Asian Stocks Talking Points: Asian stocks trim prior gains given a lack of catalysts to fuel a recovery in sentiment The RBA left rates unchanged at 1.50% as expected, offered slight Aussie weakness AUD/USD still remains at a pivotal point as it faces barriers for a lasting reversal Find out what retail traders’ Australian Dollar […]

Read more June 5

June 52018

GBPUSD to Come Under Renewed Pressure on Brexit Concerns

GBP talking points: – The UK government’s Brexit White Paper may be delayed until after an EU Summit at the end of June. – With UK political worries rising again, this month’s mini rally in GBPUSD could well be reversed. Check out the IG Client Sentiment data to help you trade profitably. And for a […]

Read more June 5

June 52018

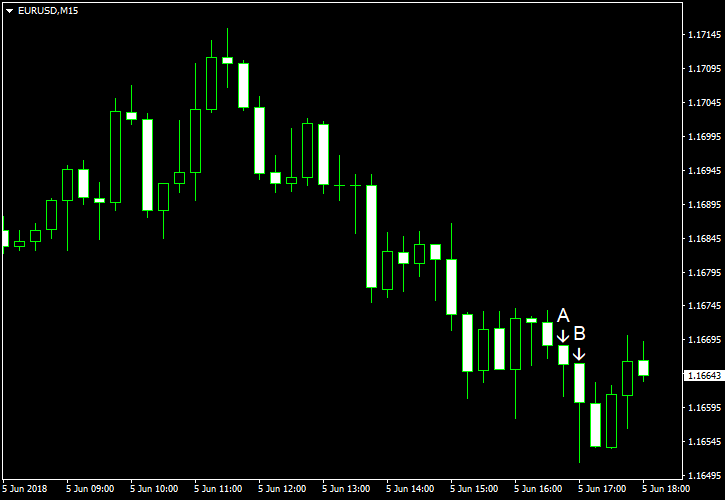

EURUSD Chart: Ominous Death-Cross Portends Lower Prices

EURUSD News and Talking Points – EURUSD chart looks weak and the downtrend remains intact. – US Treasury yields edging back towards recent highs. The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are now availableto download to help you make more informed trading decisions. EURUSD Remains Weak with Further Losses Likely […]

Read more June 5

June 52018

GBPUSD Cheers Hat-trick of PMI Surveys Signaling UK GDP Rebound

GBPUSD Analysis and News UK Services Rises to Best Level Since December, BoE rate hike expectations lifted PMI Surveys Indicate UK Q2 GDP at 0.3-0.4% UK PMIs Signal Rebound in UK Growth GBP rose to its best levels of the day against the USD to 1.3378 from 1.3332 following the latest UK Services PMI report, […]

Read more June 5

June 52018

Gold Price Continues to Battle the Downtrend; G7 Ahead

Gold Price News and Analysis – Gold’s chart points to lower prices. – Retail investors remain heavily long of the precious metal – are they right? The DailyFX Q2 Gold Forecast is now available to help traders navigate the market. The latest IG Retail Sentiment Indicatorshows that traders are 81.2% net-long of the precious metal […]

Read more June 5

June 52018

Risk Appetite Revives, But Only Modestly | Webinar

Market sentiment analysis and talking points: – Market confidence is improving as traders look to the global economy rather than trade wars. – However, so far, the move from safe havens into more risky assets has been relatively light. The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices are now availabletodownload to […]

Read more June 5

June 52018

US AM Digest: GBP Outperforms After PMI, Oil Slips as the US Pressure OPEC to Raise Production

US Market Snapshot via IG: DJIA 0.01%, Nasdaq 100 0.2%, S&P 500 0.01% Major Headlines RBA maintains interest rate at 1.5%, sticks to neutral stance US is said to have asked OPEC to raise oil production UK Services PMI reaches best level since December GBP: The Pound is the best performer in the G10 FX […]

Read more June 5

June 52018

EUR/USD Slips After US Services Data

EUR/USD fell today, changing its direction for the third day in a row. Some market analysts predicted that the currency pair will be trading in a range in a near future as the most important fundamentals, like geopolitical risks and monetary policy, are already priced in. Meanwhile, both reports about the US service sector released today beat expectations, driving the EUR/USD pair further down, though currently it is attempting […]

Read more