US Market Snapshot via IG: DJIA 0.5%, Nasdaq 100 0.3%, S&P 500 0.3%

Major Headlines

- ECB Governors confirm that the ECB will discuss QE exit next week

- Australian Q1 GDP beats expectations (3.1% vs. Exp. 2.8%)

- US and Canadian Trade Deficit narrows.

AUD: The Australian Dollar is on the front foot this morning following a strong GDP print. Q1 GDP rose 1%, representing an annual growth of 3.1% vs. Exp. 2.8% after a jump in business investment. This also follows on from Tuesday’s RBA meeting whereby the central bank had been upbeat over future economic growth (concerns remain over inflation). As such, this bodes well for AUD, which given the bearish positioning in the currency could see AUDUSD to push for better levels towards 0.7700 on possible short covering.

EUR: Yesterday, ECB source reports did the rounds, which highlighted that next week’s monetary policy decision (June 14th) should be considered as a “live” meeting to discuss QE exit. In the wake of the source report, this has prompted a slew of ECB speakers to confirm that a discussion over QE exit will be on the agenda. In response to the source report and following ECB comments, the Euro has pushed to better levels to consolidate above 1.17, reaching a high of 1.1780. Subsequently, 1-week EURUSD reversals have flipped with Euro calls now trading at a premium to puts, suggesting near-term gains for the pair.

CAD: The Loonie notable stronger against the greenback amid reports that US Treasury Secretary Mnuchin had urged President Trump to exempt Canada from steel and aluminium tariffs. Consequently, USDCAD has trended lower throughout the morning before making another leg lower on the back of a narrower than expected trade deficit.

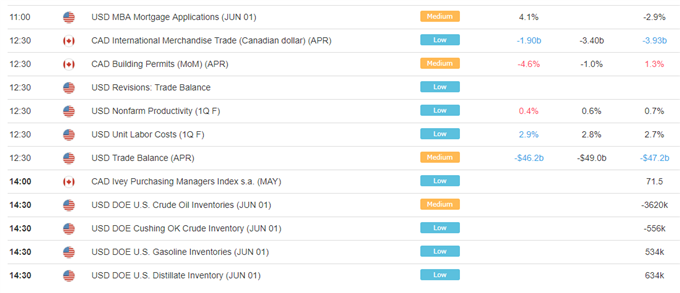

DailyFX Economic Calendar: Wednesday, June 6, 2018 – North American Releases

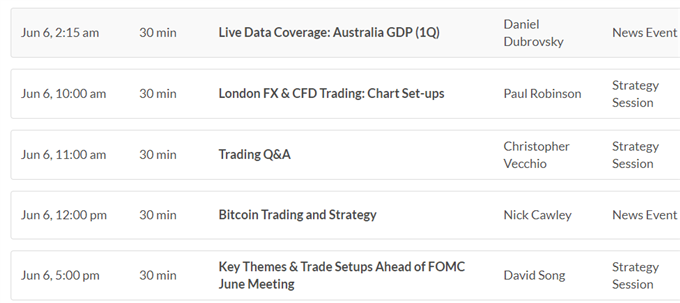

DailyWebinar Calendar: Wednesday, June 6, 2018

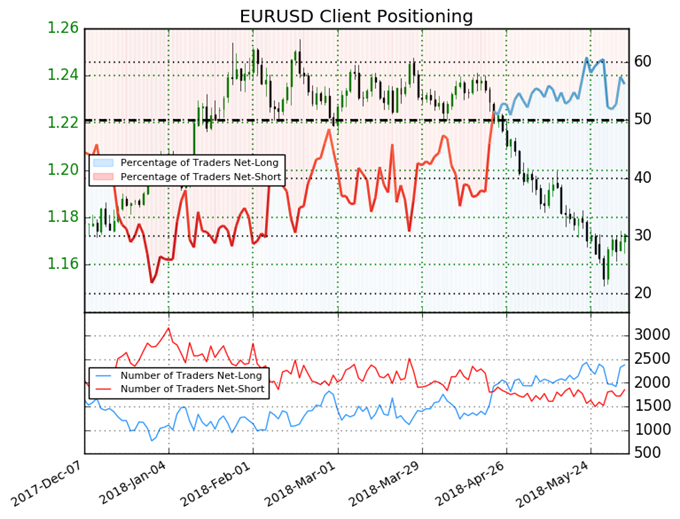

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 56.2% of traders are net-long with the ratio of traders long to short at 1.28 to 1. In fact, traders have remained net-long since Apr 30 when EURUSD traded near 1.21686; price has moved 3.6% lower since then. The number of traders net-long is 2.4% higher than yesterday and 1.9% higher from last week, while the number of traders net-short is 1.9% lower than yesterday and 17.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Five Things Traders are Reading

- “Euro Turns Higher on QE Speculation Ahead of ECB Next Week” by Christopher Vecchio, CFA, Sr. Currency Strategist

-

“

Cryptocurrencies: Trading Ranges Holding; Google Searches Slump | Webinar”

by Nick Cawley, Market Analyst - “Trading Outlook for EUR/USD, AUD/USD, Yen Pairs, Gold & More”by Paul Robinson, Market Analyst

- “EURUSD Rises as the ECB Look to Debate QE Exit” by Justin McQueen, Market Analyst

- “Trade Conflict at G7 Summit May Rub Salt Into USD Wounds” by Martin Essex, MSTA , Analyst and Editor

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX