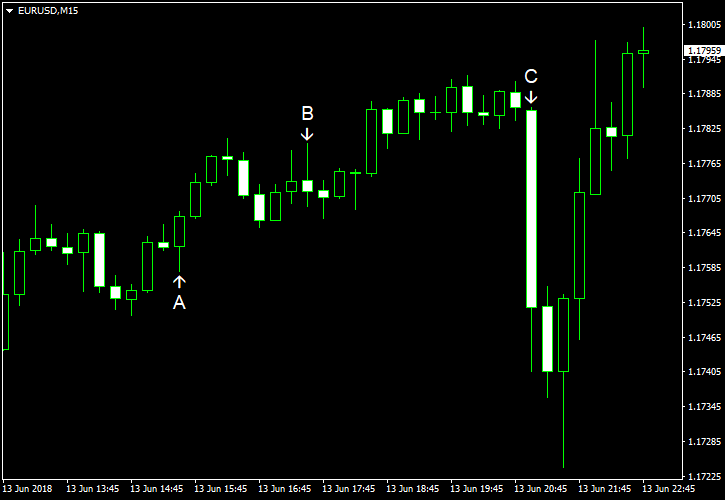

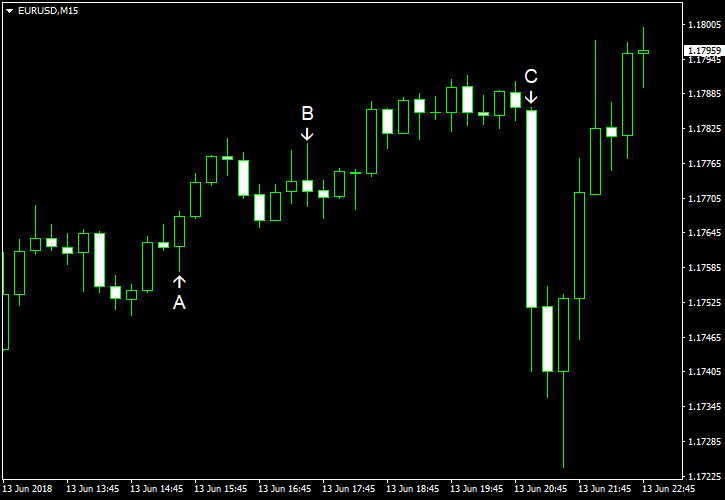

EUR/USD tumbled today after the Federal Open Market Committee hiked its main interest rate and updated its economic projections, predicting four hikes in total this year. Yet, surprisingly, the currency pair has recovered extremely quickly and is now trading far above the opening level.

PPI rose 0.5% in May, seasonally adjusted, beating the average forecast of 0.3% and the previous month’s increase of 0.1%. (Event A on the chart.)

US crude oil inventories shrank by 4.1 million barrels last week, much more than analysts had predicted — 1.4 million. The week before, the stockpiles increased by 2.1 million. Total motor gasoline inventories decreased by 2.3 million barrels. (Event B on the chart.)

FOMC hiked the federal funds rate by 25 basis points to 1.75%-2.0% today. While such decision was not unexpected, a surprise came in the form of the updated projections. In particular, the FOMC raised the projected appropriate policy path, meaning that policy makers anticipate two more hikes this year instead of just one in the previous forecasts. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.