US Market Snapshot via IG: DJIA -0.7%, Nasdaq 100 -0.5%, S&P 500 -0.5%

Major Headlines

- President Trump approves $50bln tariffs on Chinese goods

- BoJ stands pat on monetary policy and cuts inflation assessment

USD: The greenback had printed fresh 2018 highs on the back of the diverging monetary policy stance between the ECB and Fed. Reminder, yesterday saw the ECB state that rate hike will not come before September 2019, while the FOMC had increased their short-term rate hike path for 2018 (4 hikes vs. Prev. 3 hikes). However, the earlier gains had been pared amid the rising trade tensions with President Trump approving $50bln worth of tariffs on China imports relating to technology. Focus will be on how China reacts.

EUR: The Euro has seen some marginal gains this morning as Euro shorts take profit, however, upside gains are capped by resistance at 1.1600-20, while uncertainty now over German politics looks to potentially renew fresh EUR selling. Merkel’s leadership is under-threat by the CSU over a rift with regard to immigration, subsequently, Merkel will most likely have discussions over the weekend in order to provide a resolution. However, failure to do so could prove detrimental to Chancellor amid the possibility of a vote of confidence or a snap election. Meanwhile near term target on the downside is the June low at 1.1510, a close below could open up the doors for 1.1450.

JPY: Overnight, the BoJ released their latest monetary policy decision. Unsurprisingly, the central bank stood pat on policy, as such, the reaction in the JPY had been relatively muted. With inflation still some way away from their target, the BoJ yet again cut its assessment on inflation, so looks as if QQE is here to stay for some time. A greater influence on the JPY is likely to be the concerns surrounding trade wars with President Trump approving $50bln worth of import tariffs on China.

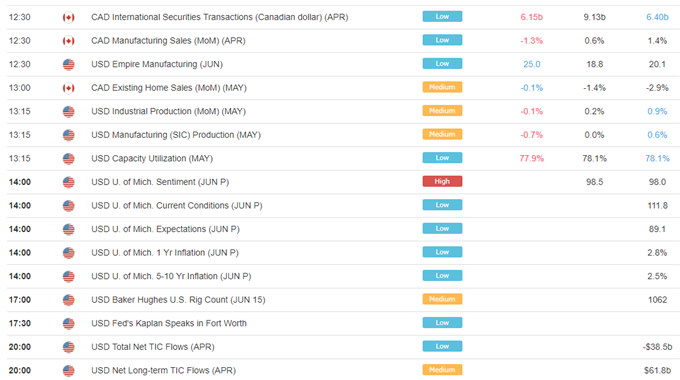

DailyFX Economic Calendar: Friday, June 15, 2018 – North American Releases

DailyWebinar Calendar: Friday, June 15, 2018

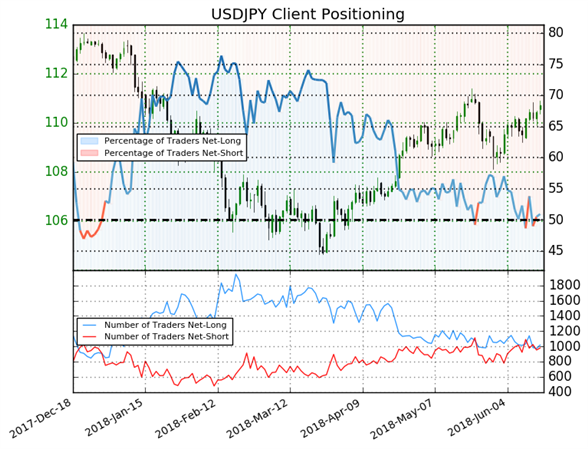

IG Client Sentiment Index: USDJPY Chart of the Day

USDJPY: Data shows 50.9% of traders are net-long with the ratio of traders long to short at 1.04 to 1. The number of traders net-long is 0.7% higher than yesterday and 4.9% lower from last week, while the number of traders net-short is 8.5% lower than yesterday and 6.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias.

Five Things Traders are Reading

- “DXY Index Pauses at Yearly High as China-US Trade War Escalates” byChristopher Vecchio, CFA, Sr. Currency Strategist

- “Charts for Next Week – USD/JPY, Yen-rates, AUD/USD, Gold Price & More” by Paul Robinson, Market Analyst

- “US Dollar Shrugs Off US-China Trade War Escalation for Now”by Nick Cawley, Market Analyst

- “EUR Bears to Remain in Control on Possible German Snap Election”by Justin McQueen, Market Analyst

- “Another Potential Blow for Euro as Germany’s CSU Defies Merkel” by Martin Essex, MSTA, Analyst and Editor

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX