GBP Analysis and Talking Points

- BoE to keeps rates unchanged amid mixed batch of economic data

- Focus on accompanying statement and Carney’s Mansion House speech.

IG Client Positioning Sentiment states recent changes in sentiment warn that current GBPUSD price trading bias is mixed. For full client positioning click here

BoE Expected to Stand Pat on Monetary Policy

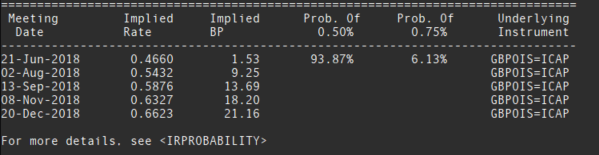

The Bank of England will announce its latest interest rate decision at 1100GMT, where the central bank is expected to keep the bank rate at 0.5%, according to all surveyed economists. Money markets are also pricing in a near certain 93% chance that the BoE will stand pat, while the vote split will likely be a 7-2 vote split (Saunders and McCafferty the hawkish dissenters). As such, focus will be on the monetary policy statement where participants will be keeping an eye out on signals for a near term rate decision. In terms of future rate decisions, OIS markets price in a 37% chance of a 25bps rate hike in August.

Source: Thomson Reuters (BoE rate hike expectations)

Mixed UK Data Supports Reason to Keep Rates on Hold

|

UK Economic Data |

Date |

Latest |

Expected |

Verdict |

|

Employment Change (Mar) |

15th May |

197k |

129k |

Bullish |

|

Average Weekly Earnings (Mar) |

15th May |

2.9% |

2.9% |

Neutral |

|

Claimant Count (Apr) |

15th May |

31.2k |

7.5k |

Bearish |

|

CPI (Apr) |

23rd May |

2.4% |

2.5% |

Bearish |

|

Core CPI (Apr) |

23rd May |

2.1% |

2.2% |

Bearish |

|

Retail Sales (Apr) |

24th May |

1.4% |

0.1% |

Bullish |

|

Core Retail Sales (Apr) |

24th May |

1.5% |

0.1% |

Bullish |

|

Q1 GDP Secondary Reading |

25th May |

0.1% |

0.1% |

Neutral |

|

Manufacturing PMI (May) |

1st June |

54.4 |

53.5 |

Bullish |

|

Construction PMI (May) |

4th June |

52.5 |

51.9 |

Bullish |

|

Services PMI (May) |

5th June |

54 |

53 |

Bullish |

|

Industrial Output (Apr) |

11th June |

1.8% |

2.7% |

Bearish |

|

Manufacturing Output (Apr) |

11th June |

1.4% |

2.9% |

Bearish |

|

Employment Change (Apr) |

12th June |

146k |

110k |

Bullish |

|

Average Weekly Earnings (Apr) |

12th June |

2.8% |

2.9% |

Bearish |

|

Claimant Count (May) |

12th June |

-7.7k |

11.3k |

Bullish |

|

CPI (Apr) |

13th June |

2.4% |

2.5% |

Bearish |

|

Core CPI (Apr) |

13th June |

2.1% |

2.1% |

Neutral |

|

Retail Sales (May) |

14th June |

3.9% |

2.4% |

Bullish |

|

Core Retail Sales (May) |

14th June |

4.4% |

2.5% |

Bullish |

Source: DailyFX (UK Economic Data Since BoE’s May Meeting) *Please send feedback on table if helpful

Since the last Bank of England meeting, economic data has been somewhat mixed with the UK labour market continuing to remain robust, while average earnings have continued to surpass inflation, resulting in a more optimistic outlook for consumer spending. However, inflation has eased and continues to hover around 1-year lows, which in turn reduces the necessity for the Bank of England to raise rates, alongside this, softening underlying economy persists, subsequently denting the growth outlook.

Trading the BoE

Given that market pricing shows a 93% chance of a Bank of England hold, it is likely that the central bank maintaining rates the bank rate 0.5% is unlikely to impact the Pound. Consequently, with no economic projections or press conference, focus will be on the accompanying minutes.

It is likely that the BoE continues to adopt a “wait and see” approach with their view on near-term rate hikes little changed (limited and gradual rate hikes) from May as they look for further evidence that growth remains on an upward trajectory, following its Q1 disappointment (Reminder, first Q2 growth reading is after BoE August decision). Recent business surveys have seen a modest rebound, which will likely see the BoE maintain its general upbeat assessment and judgment that rate hikes will be needed and in turn should keep GBP supported. However, references to heightened political risks, most notable Brexit which has taken the Pound to a fresh 7-month low, could place GBPUSD under renewed pressure.

Bank of England Governor Speaks at Mansion House

For stronger BoE communication, eyes will be on Governor Carney’s speech at the Mansion House after the BoE meeting at 2015GMT, where participants may receive the current BoE view of the recent economic trends. Reminder, Carney last spoke on May 24th and stated that the BoE could tolerate a lengthier inflation overshoot and endorsed gradual path for rate rises.

GBPUSD Price Chart: Daily Time-Frame (October 2016-June-2018)

Support: 1.3100, 1.3072 (50% fibonacci retracement of 1.1800-1.4377 rise), 1.3027 (October 207 low)

Resistance: 1.3200, 1.3204 (May 29th swing low), 1.3250 (Descending trendline from 2018 peak)

Additional articles regarding the Pound

- GBPUSD Forecast – Sterling Sell-Off Nears Critical Support

- GBPUSD at Risk from Brexit Vote and Bank of England

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX