EURO, EU IMMIGRATION DEAL TALKING POINTS:

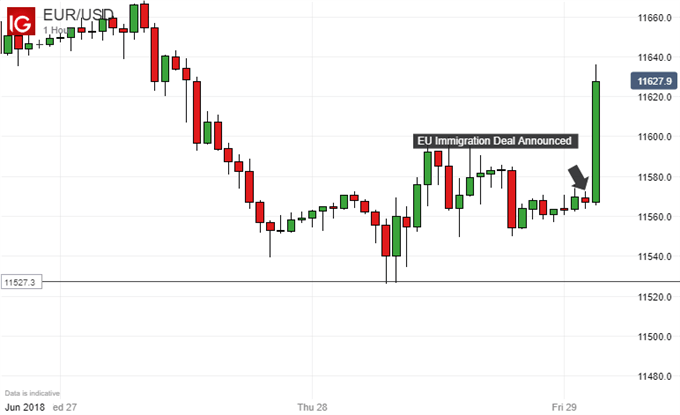

- The Euro gained sharply on Friday

- European Council President Donald Tusk announced a late night deal on immigration

- Markets had feared damaging deadlock

Find out what the #1 mistake that traders make is and how you can fix it!

The Euro rose sharply on Friday on news that European Union leaders had reached a deal at their Brussels summit on the highly charged issue of immigration into the bloc.

The Italians had sought further negotiation on the subject but President of the European Council and summit chair Donald Tusk said that an accommodation had been possible- after ten hours of talks- in the early hours of Friday European time.

“EU28 leaders have agreed on (summit) conclusions, including on migration,” Tusk said, according to Reuters. Details of remained scant, but the fact that a deal of any sort had been struck was enough to unleash Euro bulls. Markets knew that German Chancellor Angela Merkel had said that the summit could be a defining moment for the EU before the fact.

The single currency gained, notably against the US Dollar, Japanese Yen and UK Pound.

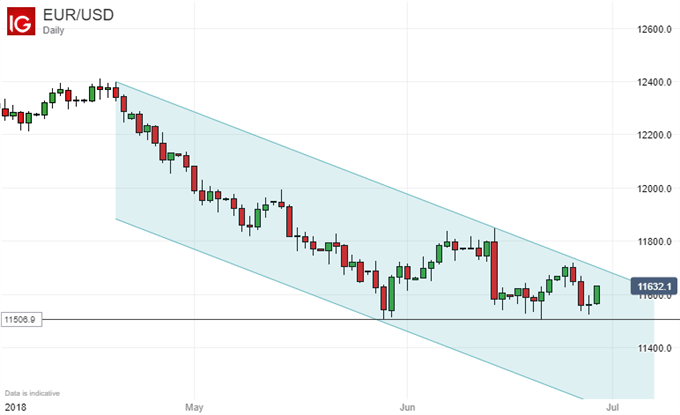

On its broader, daily chart the EUR/USD remains well within the downtrend which has dominated for much of 2018 as interest-rate differentials remain so firmly in the US Dollar’s favour.

However, the single currency does appear to have found quite firm support at the lows of May 30, which have also stymied June’s bearish forays to date.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

— Written by David Cottle, DailyFX Research

Follow David on Twitter@DavidCottleFX or use the Comments section below to get in touch!