US Market Snapshot via IG: DJIA 0.6%, Nasdaq 100 0.5%, S&P 500 0.4%

Major Headlines

- CSU and CDU agree migration deal, however, SPD have rejected the proposal

- PBoC Verbal Intervention curbs Yuan decline

- UK Construction PMI rises to highest level in 7 months

- RBA stand pat on interest rates at 1.5%

AUD: The RBA kept its OCR at 1.5% and provided no new clues on when the next rate hike will take place, however, the central bank did highlight concerns over the global trade environment. A relatively muted reaction in the wake of the latest RBA rate decision. A larger focus for Aussie traders were the developments in China, in which the PBoC finally stepped in to curb the decline seen in the Yuan. Both the Governor and Deputy Governor of the PBoC stated that China will keep the Yuan basically stable, while major state-owned banks had been selling dollars to prop up the Yuan. In turn, AUDUSD is back above 0.7400 with next resistance seen at 0.7415.

GBP: The UK construction PMI reading accelerated to its highest level since November 2017. This follows yesterday’sbetter than expected manufacturing PMI data, adding to the evidence that weak data in Q1 had indeed been due to temporary factors, which has been argued by the Bank of England and as such suggests that a rate hike may be on the horizon. Attention will now turn towardsthe UK service PMI to complete the picture. GBP trading at better levels having made a break above 1.32.

EUR: A tentative bounce in the Euro after CDU and CSU reach an agreement on migration. However, risks remain after reports later suggesting that the third member in the coalition, the SPD, have rejected the agreement. As such, gains in the currency has been pared with EURJPY shying away from 129.00.

DailyFX Economic Calendar: Tuesday, July 3, 2018 – North American Releases

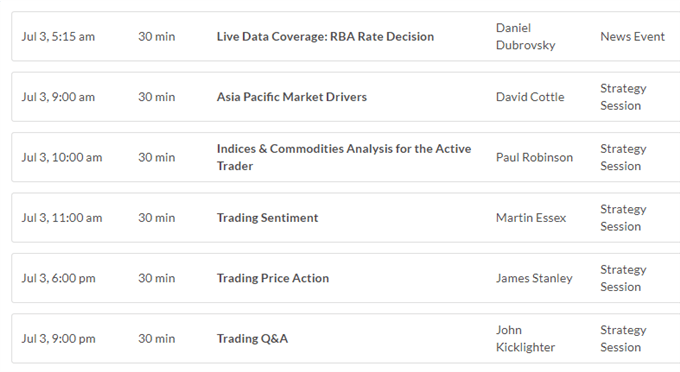

DailyWebinar Calendar: Tuesday, July 3, 2018

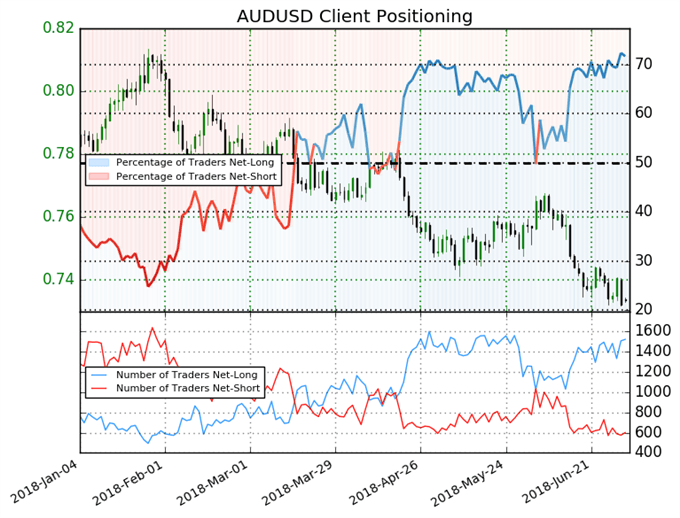

IG Client Sentiment: AUDUSD Chart of the Day

AUDUSD: Retail trader data shows 71.7% of traders are net-long with the ratio of traders long to short at 2.53 to 1. In fact, traders have remained net-long since Jun 05 when AUDUSD traded near 0.75624; price has moved 3.0% lower since then. The number of traders net-long is 12.6% higher than yesterday and 3.7% higher from last week, while the number of traders net-short is 11.1% lower than yesterday and 6.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias

Five Things Traders are Reading

- “DXY Index Carving Out Second Straight Inside Day Before US Holiday” by Christopher Vecchio, CFA, Sr. Currency Strategist

- “Market Sentiment Holds Up Despite Trade War Worries | Webinar” by Martin Essex, MSTA , Analyst and Editor

- “Gold Price at Support; Technical Outlook for Crude Oil, DAX & S&P 500”by Paul Robinson, Market Analyst

- “Yuan Declines to Persist Despite PBoC Intervention”by Justin McQueen, Market Analyst

- “EUR Downside Beckons Despite German Coalition Deal” by Martin Essex, MSTA , Analyst and Editor

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX