US Market Snapshot via IG: DJIA 0.45%, Nasdaq 100 0.5%, S&P 500 0.4%

Major Headlines

- Brexit Minister Resigns over PM May’s Soft Brexit Plan

- German Trade Surplus Supported by Rising Exports

USD: Broad based selling in the greenback continues amid the improvement in risk sentiment. Additionally, market participants continue to digest the latest lacklustre NFP report, while the recent upside surprises in UK and Euro-Area data has narrowed the divergence with the US. Consequently, this has supported the EUR and GBP vs. USD, which has pulled further away from the 94 handle.

GBP: On Friday, PM May’s “soft” Brexit plan had been agreed among cabinet ministers at the Chequers meeting, which led to a move higher in the Pound against its major counterparts with GBPUSD rising above 1.33. GBP gains survive for now, despite, resignations overnight from Brexit Minister David Davies and two additional government ministers’ which casts doubts on the plan and the ability for the UK to get a deal done by the October EU meeting.

EUR: Germany reported a wider than expected trade surplus on a seasonal adjusted basis, which had been predominantly led by rising exports. This is despite the current environment of trade disputes with the US. Alongside this, investor morale had enjoyed a modest bounce back, according to Sentix. The Euro continues to press for better levels, with the next upside target at 1.18 for a potential run in on 1.1850.

DailyFX Economic Calendar: Friday, July 9, 2018 – North American Releases

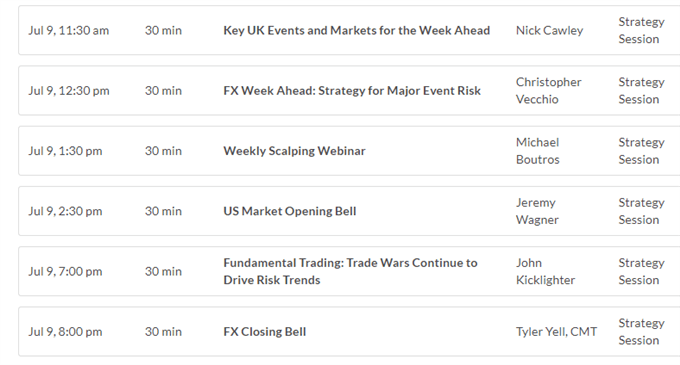

DailyWebinar Calendar: Friday, July 9, 2018

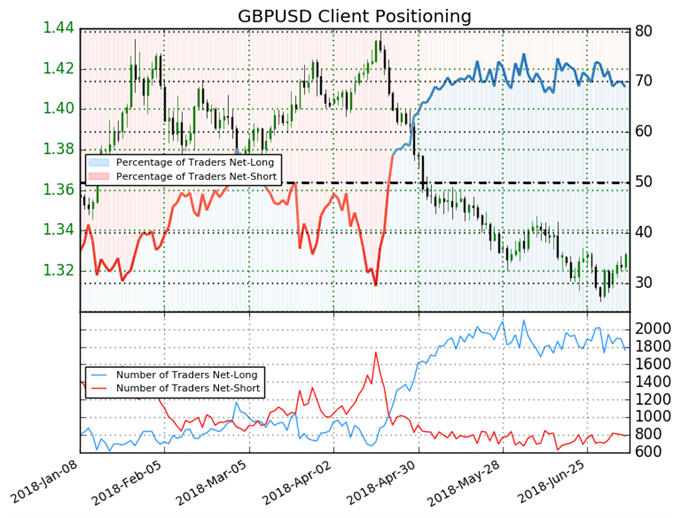

IG Client Sentiment: GBPUSD Chart of the Day

GBPUSD: Retail trader data shows 69.0% of traders are net-long with the ratio of traders long to short at 2.22 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.40897; price has moved 5.7% lower since then. The number of traders net-long is 6.1% lower than yesterday and 1.7% higher from last week, while the number of traders net-short is 8.3% lower than yesterday and 10.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

Five Things Traders are Reading

- “Euro Forecast: Euro Stabilization to Continue as Attention Turns to Draghi” by Christopher Vecchio, CFA, Sr. Currency Strategist

- “Ripple & Litecoin Charts at a Glance – Trend Keeps Sellers in Control” by Paul Robinson, Market Analyst

- “GBP Rises as Soft Brexit Plans Suggests Risks are Tilted to the Upside”by Justin McQueen, Market Analyst

- “Euro Finds Support on Investor Morale Bounce and Widening German Trade Surplus”by Justin McQueen, Market Analyst

- “DAX Chart Analysis – Test of Resistance Zone Underway” by Paul Robinson, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX