Australian Dollar, Inflation Expectations, Talking Points:

- Australian consumer inflation expectations slid in July

- Persistently low consumer price acceleration is among the Reserve Bank of Australia’s biggest headaches

- The Australian Dollar remains pressures

See what the retail foreign exchange community makes of the Australian Dollar’s chances right now at the DailyFX Sentiment Page

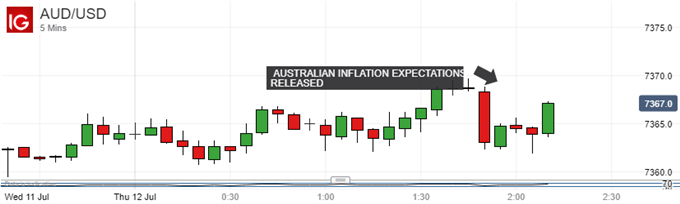

The Australian Dollar slipped just a little on Thursday as official data found consumers even less concerned about inflation than they had been in the previous month.

Consumer inflation expectations came in at 3.9% on the year for July, below the 4.2% seen in June. This probably will not please interest rate setters at the Reserve Bank of Australia. Low inflation is one of their key concerns at present and shoppers’ expectations of further price rises are a key component of policy.

Annualized Australian Consumer Price Inflation has been below the RBA target band’s lower bound of 2% for most of the time since 2014. Its stubborn weakness is perhaps the main reason why local interest-rate futures markets fail to fully price even a single quarter-point increase in the record-low, 1.5% Official Cash Rate either this year or next.

This contrast between this prognosis and the aggressive interest-rate hawkishness of the US Federal Reserve has weighed heavily on AUD/USD.

This pervasive backdrop is always likely to reassert itself and stymie Aussie bulls, who have in any case to struggle with the possibility of new trade war headlines of the sort, which have already weighed on the currency. We can see an example of this on the daily chart below. AUD/USD briefly traded above its previous range only to slide back into it this week as the US contemplated new tariffs on yet more Chinese imports.

The Australian Dollar can act at the foreign exchange market’s favorite liquid China-growth proxy given its home country’s famed raw material export links with China.

Technical focus now is on the base of that support band which has so far held AUD/USD bears in check. Should it fail to do so on another test, which looks likely, the pair will be down to lows not seen since the start of 2017.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

— Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!