- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 4, 2018

September 4

September 42018

US Dollar Rallies on Trade War Fears, ISM Manufacturing Data

The US dollar rallied against all of its major rivals today. Market analysts explained the rally by risk aversion caused by trade war fears, though many also mentioned the unexpectedly positive manufacturing report. Investors were nervous today, anticipating that the planned tariffs on $200 billion worth of Chinese goods may take effect as soon as Thursday. The lack of progress in NAFTA talks between the United States and Canada also made […]

Read more September 4

September 42018

Rand Drops After South African Economy Enters Recession

The South African rand dropped today, touching the lowest level since June 2016 against the US dollar, after the nation’s economy entered recession unexpectedly. South Africa’s gross domestic product fell 0.7% in the June quarter on a seasonally adjusted annualized basis. Market participants had expected an increase by 0.6%. GDP contracted 2.6% in the previous quarter. The second consecutive quarterly decline means that the economy has officially entered recession. […]

Read more September 4

September 42018

Canadian Dollar Stumbles to Six-Week Low on Trump-NAFTA Remarks

The Canadian dollar stumbled to its lowest level in six weeks on Tuesday after President Donald Trump suggested that it is not necessary to keep Canada in a new trade deal, a remark that comes a week after reaching an agreement with Mexico. The loonie will now try to find momentum in upcoming economic data. On Saturday, President Trump tweeted that a fair deal is required, otherwise âCanada will be […]

Read more September 4

September 42018

British Pound Drops on UK Construction PMI, Later Rallies on Carney

The British pound today dropped to new lows extending yesterday’s decline following the release of disappointing UK construction data earlier today. The GBP/USD currency pair later rallied higher following the testimony by the Bank of England Governor before the UK parliament where he promised to help smooth the Brexit process. The GBP/USD currency pair today dropped from an opening high of 1.2868 to a low of 1.2813 in the early European session before rallying higher. […]

Read more September 4

September 42018

Swiss Franc Soft Despite Stable Consumer Prices

The Swiss franc was rather soft during Tuesday’s trading despite today’s macroeconomic data, which showed that Switzerland’s consumer prices were stable last month. Swiss Federal Statistics Office reported that the Consumer Price Index was unchanged in August from the previous month, in line with expectations. In July, the CPI fell 0.2%. Year-on-year, the index increased 1.2% last month. USD/CHF jumped from 0.9689 to 0.9738 […]

Read more September 4

September 42018

Australian Dollar Fails to Hold Ground After RBA Meeting

The Australian dollar attempted to hold its ground after the policy meeting of the Reserve Bank of Australia but failed and is now trading below the opening level. The worse-than-expected current account balance added to the downside momentum of the currency. The RBA kept its main interest rate unchanged at 1.5% at today’s meeting. Such decision was widely expected by market participants. The statement did not provide many new insights, showing a largely positive […]

Read more September 4

September 42018

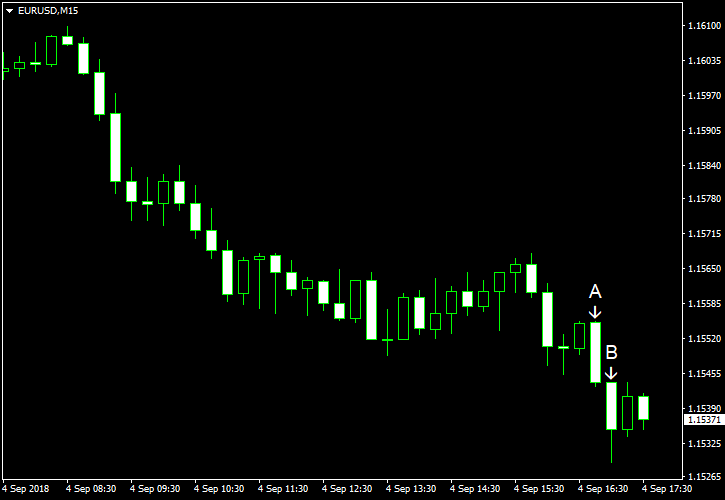

EUR/USD Declines on Risk Aversion, Surge of ISM Manufacturing PMI

EUR/USD declined today on risk aversion caused by various issues, including fears of trade wars. The currency pair declined also after the manufacturing Purchasing Managers’ Index of the Institute for Supply Management showed an unexpected sharp increase. Currently, though, the EUR/USD pair trades in a consolidation mode. Markit manufacturing PMI fell to 54.7 in August from 55.3 in July according to the revised estimate, registering the weakest reading since November. (Event A on the chart.) Analysts […]

Read more