- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 19, 2018

September 19

September 192018

Chinese Yuan Strengthens Despite Economic Warnings at WEF

The Chinese yuan is strengthening midweek against its American counterpart, despite warnings from officials about the national economy. The Chinese economy was a key subject of discussion at this yearâs annual World Economic Forum (WEF) in Tianjin. This comes as the worldâs two largest economies slapped tariffs on both of their exports on Tuesday. Speaking at the WEF, Chinese Premier Li Keqiang explained that the government understands that the nation faces […]

Read more September 19

September 192018

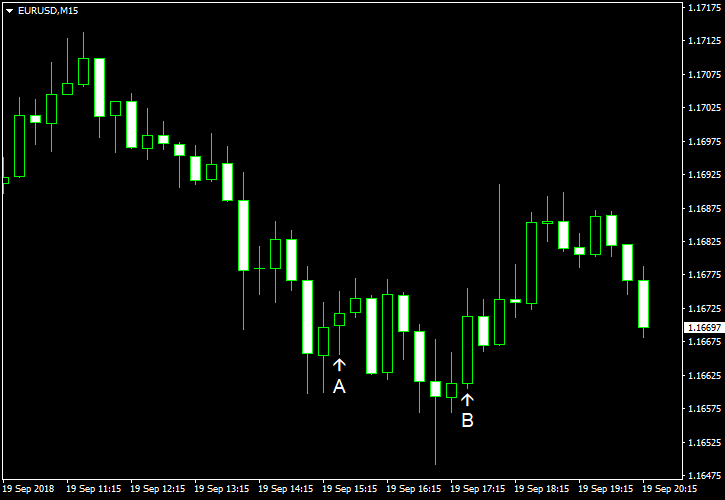

Euro Fails to Hold On to Gains on Resurgent US Dollar Demand

The euro today rallied to new highs in the early European session even as German bond yields hit new tops and the US dollar retreated. However, the EUR/USD currency pair proceeded to give up all its gains as the greenback rebounded amid rising US bond yields and Irish border concerns. The EUR/USD currency pair today rallied to a high of 1.1715 before retracing all its gains to fall to a low of 1.1649 in the early American […]

Read more September 19

September 192018

Pound Rallies on Upbeat UK Inflation Data, Declines on Brexit News

The Sterling pound today rallied higher against the US dollar following the release of the latest UK inflation data, which beat expectations by a huge margin. The GBP/USD currency pair today rallied to new six-week highs following the positive releases, but later dropped to new lows due to negative Brexit headlines. The GBP/USD currency pair today rallied to a high of 1.3215 in the early European session before dropping to a low of 1.3098 on Brexit headlines. […]

Read more September 19

September 192018

Japanese Yen Remains Soft After BoJ, Trade Balance

The Japanese yen remained broadly weaker against its most-traded rivals. While domestic releases were unfavorable to the currency, the major reason for the yen’s weakness was the market sentiment that favored riskier currencies, not safer ones. The Bank of Japan delivered no surprises at today’s policy meeting, leaving the main interest rate at -0.1% and the target yield for 10-year Japanese government bonds at around 0%. The size of annual asset purchases remained […]

Read more September 19

September 192018

Positive Market Sentiment Allows Aussie to Ignore Economic Data

The Australian dollar rallied today despite lackluster macroeconomic data. The currency got support from the positive market sentiment that ignored the latest developments in the US-China trade war. The six month annualized growth rate in the WestpacâMelbourne Institute Leading Index fell from 0.5% in July to -0.02% in August. Yet the Aussie rallied as the markets continued to ignore the escalation of US-China trade tensions. In addition, the traders’ mood improved further after Chinese Premier […]

Read more September 19

September 192018

NZ Dollar Rallies on Positive Sentiment, Dismisses Underwhelming Data

Macroeconomic data released in New Zealand today was unfavorable to the New Zealand dollar. Yet the currency managed to rise nonetheless, likely boosted by the same positive sentiment that helped its Australian counterpart. The Westpac Consumer Confidence Index dropped from 108.6 in the June quarter to 103.5 in the September quarter, reaching the lowest level in six years. The current account turned from the surplus of NZ$0.09 billion to a deficit of NZ$1.62 billion in the June quarter […]

Read more September 19

September 192018

EUR/USD Attempts to Hold onto Gains as US Yields Surge

EUR/USD attempted to rally today but retreated as yields for 10-year US treasuries surged, breaking the 3% level this week, and today’s macroeconomic data released from the United States was mostly good. The currency pair was still hanging above the opening level. Housing starts were at the seasonally adjusted annual rate of 1.28 million in August, up from 1.17 million in July. Analysts had predicted a smaller increase to 1.24 […]

Read more