- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: April 5, 2019

April 5

April 52019

Canadian Dollar Falls on Weak Jobs Data Amid Mixed NFP Report

The Canadian dollar today fell against its US counterpart following the release of weak Canadian jobs data for March in the early American session. The USD/CAD currency pair rallied to new highs following the release of the weak jobs data from Canada as well as the upbeat US non-farm payrolls report. The USD/CAD currency pair today rallied from a low of 1.3345 in the European session to a high of 1.3402 following the dual jobs reports before retracing […]

Read more April 5

April 52019

Mexican Peso Strengthens Amid Trumpâs Border Shutdown Threat

The Mexican peso is rising against several currencies at the end of the trading week. The pesoâs recent rally comes as President Donald Trump threatened to close the border, a move that many have estimated would cost both countries billions of dollars in lost commerce. On the domestic front, the federal government plans to curb spending amid slower economic growth and falling crude oil production, leaving financial analysts with the impression that the country […]

Read more April 5

April 52019

US Dollar Volatile After Nonfarm Payrolls

The US dollar demonstrated extremely volatile reaction to nonfarm payrolls, falling then rebounding immediately. As it was usual lately, the employment report did not produce a clear picture of the US labor market, having both good and bad parts. On one hand, the report from the Bureau of Labor Statistics showed an increase of employment by healthy 196,000 in March, which was above the consensus forecast of 172,000. The February abysmal figure of 20,000 got […]

Read more April 5

April 52019

Japanese Yen Moves Sideways, Economic Data Gives No Direction

The Japanese yen traded sideways today as markets were lying in wait for US nonfarm payrolls. Domestic macroeconomic data was somewhat mixed, giving the Japanese currency no direction. Japan’s Cabinet Office reported that the leading index rose to 97.4% in February from 96.5% in January, in line with expectations. The Statistics Bureau reported that household spending increased by 1.7% in February over a year versus the forecast of a 1.9% increase and the 2.0% […]

Read more April 5

April 52019

Australian Dollar Flat After Macroeconomic Data

The Australian dollar traded about flat today after the release of positive macroeconomic data. Traders were reluctant to make big bets ahead of very important US nonfarm payrolls. The seasonally adjusted Australian Industry Group/Housing Industry Association Australian Performance of Construction Index rose to 45.6 in March from 43.8 in February. While the index remained below the neutral 50.0 level, indicating contraction of the sector, the higher figure meant that the decline […]

Read more April 5

April 52019

Euro Rallies on German Industrial Data, Later Trades Sideways

The euro today rallied higher following the release of German industrial production data in the early European session as the print beat expectations. The EUR/USD currency pair later traded sideways amid a lack of any fundamental triggers as investors waited for the non-farm payrolls report. The EUR/USD currency pair today rallied from an opening low of 1.1218 to a high of 1.1236 before retracing some of its gains and trading sideways. The currency pair opened today’s session […]

Read more April 5

April 52019

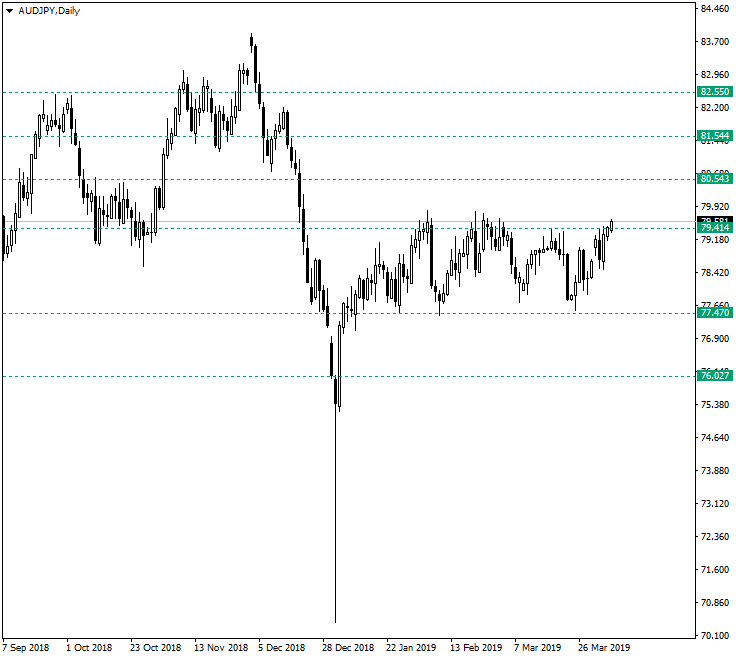

AUD/JPY Again at the Edge of the Flat

The Australian dollar vs. Japanese yen is developing at the resistance area where all the peaks of 2019 had formed. Of course, what will it do this time is the most interesting part of all. Long-term perspective Since the second half of January 2019, the pair evolves in a flat limited by 77.47 as support and 79.41 as resistance. Even thought the retracements from the support are fairly strong, the resistance manages to decrease the volatility of the price […]

Read more April 5

April 52019

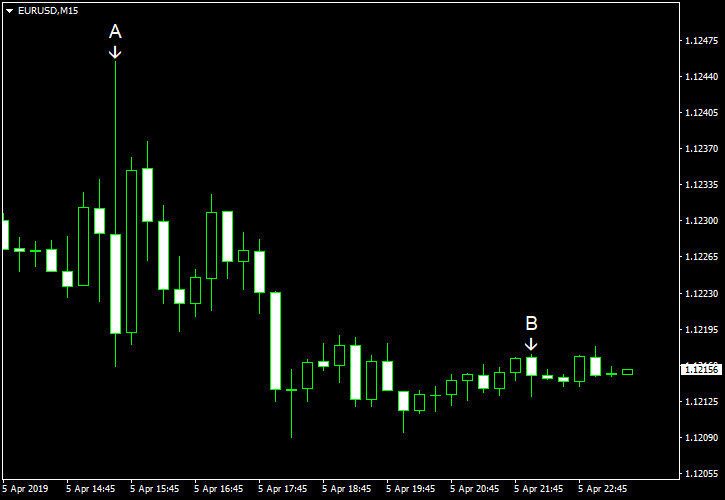

EUR/USD Volatile After NFP, Ends Losing Gains

EUR/USD was extremely volatile after the release of US nonfarm payrolls today. Initially, the currency pair attempted to rally but failed to hold onto gains and was trading slightly below the opening by the session’s end. Nonfarm payrolls showed a growth of employment by 196k in March, which exceeded the average forecast of 172k. The February reading got a revision from 20k to 33k. Unemployment rate remained stable at 3.8%. Average hourly earnings rose […]

Read more