- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 1, 2019

May 1

May 12019

Euro Drops on Upbeat US ADP Jobs Data, Rallies on Weak PMI Print

The euro today rallied against the US dollar for the fourth consecutive session despite the lack of releases from the European docket due to the labour day holiday. The EUR/USD currency pair today rallied higher from the early European session as investors adopted a wait and see attitude towards the greenback ahead of the FOMC interest rate decision. The EUR/USD currency pair today rallied from an initial low of 1.1212 to a high of 1.1248 in the American session following […]

Read more May 1

May 12019

US Dollar Slides Amid Trump-Fed Battle Over Interest Rates

The US dollar is sliding midweek as President Donald Trump continues to pressure the Federal Reserve cut interest rates because the economy would ascend âlike a rocket.â An influx of mixed data has also been coming out, showcasing some bright spots and some dim aspects that could be signs of a somewhat cooling economy. On Tuesday, President Trump tweeted that the US central bank should consider reducing rates […]

Read more May 1

May 12019

AUD/NZD Follows the Plan and Confirms 1.0546 Support

The decline that started around 1.0700 on the Australian dollar versus the New Zealand dollar currency pair looks like it is making the first step towards confirming a weekly major support area. Long-term perspective After the rally that started at 1.0300 and pierced the resistance of the descending trend managed to continue without looking back until it touched the 1.0666 second weekly major support, the price corrected in the form of a retracement to the first […]

Read more May 1

May 12019

EUR/USD Loses Day’s Gains After Powell Cools Interest Rate Cut Bets

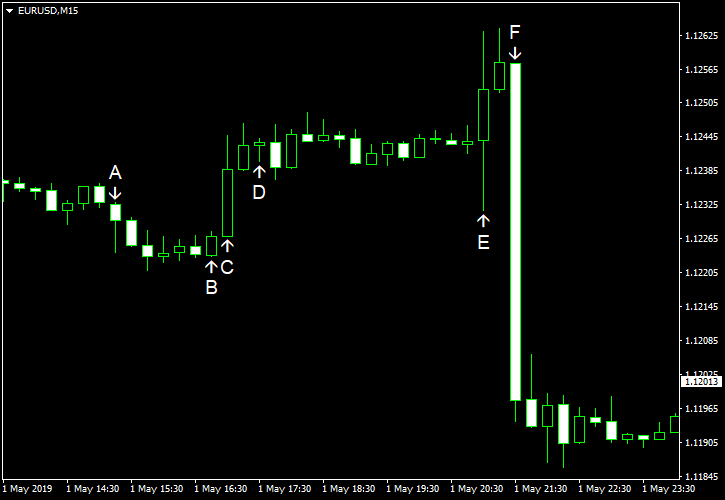

EUR/USD was rising on Wednesday, largely ignoring positive employment data, after manufacturing indices missed expectations. The currency pair attempted to extend rally after the Federal Open Market Committee left interest rates unchanged, but plunged after Jerome Powell, Chairman of the Federal Reserve, stated in the press conference that he sees no case to change rates in either direction in the foreseeable future. (Event F on the chart.) ADP employment […]

Read more