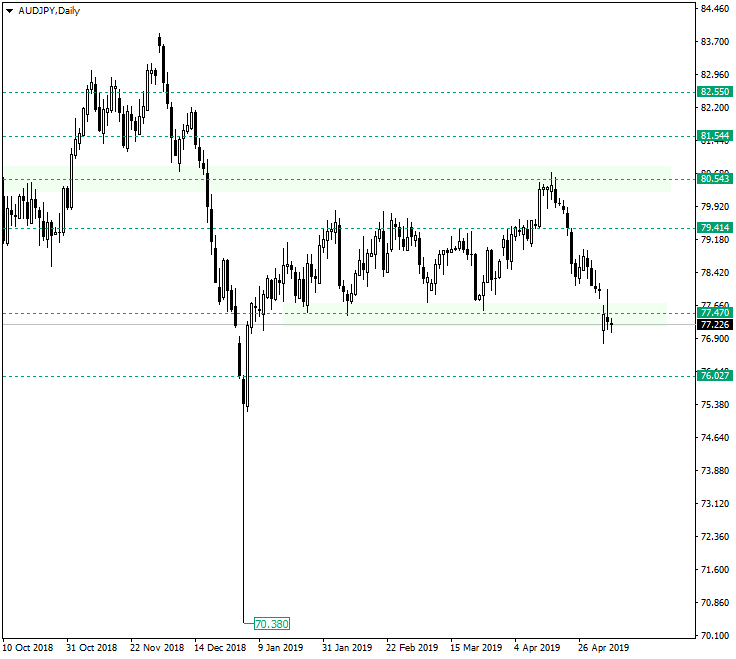

The Australian dollar versus the Japanese yen currency pair followed its course after confirming the 80.54 resistance and dropped to the 77.47 support, an area from which it has to decide where to go next.

Long-term perspective

After retracing from the 70.38 low on the start of 2019, the pair oscillated between the 79.41 resistance and the 77.47 major support. The resistance looked like is keeping the bulls in check, turning down every attempt that they made to pierce the level. So, it became clear that even if they would eventually be able to cross 79.41, it would be only in the advantage of the bears, offering them better prices go short.

And this is precisely what happen, as price pierced the 79.41 resistance only for the advancement to get stopped in its track by the 80.54 important resistance, where a hanging man followed by a bearish engulfing were formed. These two candlestick patterns represented all what the bears have been waiting for: an even better price to sell. And like that, the price went from 80.54 to 77.47.

Note that, at the time of writing, the price is under 77.47, which means that the level was breached for the first time in 2019. This could have a major psychological impact on the market. But this is a double edged knife, as May 6, 2019, printed a candle that resembles (but it is not) an inverted hammer, a pattern that suggests the end of a depreciation. So, the bulls might try a comeback from here, but their efforts could be very limited due to the current context: a strong decline from 80.54, a pierced 77.47 support area, and a candle closed under the previous mentioned level. The first target for a new decline is 76.02.

Short-term perspective

The price is in an descending channel from 78.95. After the confirmation of the double resistance area — the resistance line of the channel and the 77.91 level — the price declined and got under 77.34.

As long as the price remains contained in the descending channel, further move to the south could be expected. Also, the 77.91 resistance level may limit any rally that comes after a successful piercing of the descending channel’s resistance. 76.69 would be the first support level that a downwards move is to encounter.

Levels to keep an eye on:

D1: 77.47 76.02 79.41

H1: 77.91 77.34 76.69

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.