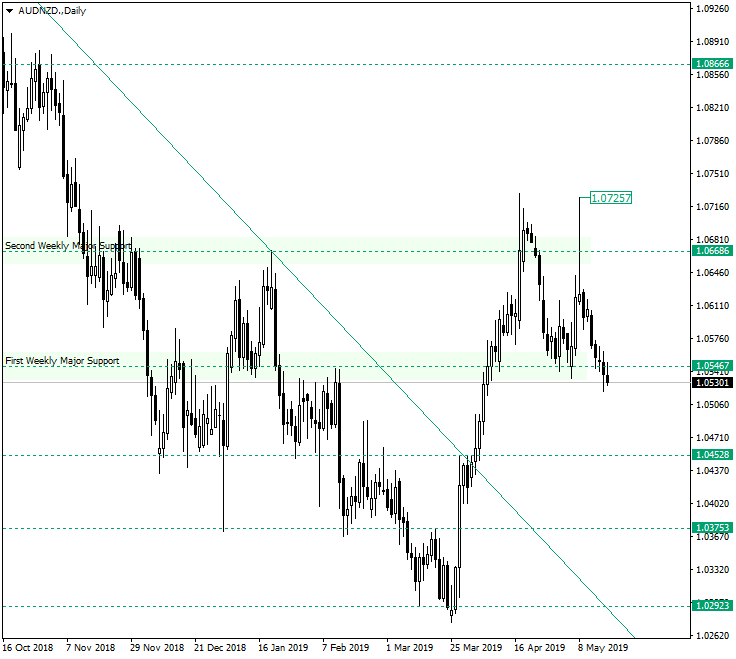

The Australian dollar vs. New Zealand dollar looks to be poised for a bearish move, even if the descending trend told a different story.

Long-term perspective

The descending trend, that began at 1.1000 end extended until 1.0292, ended after the piercing of the double resistance area consolidated by the resistance trendline of the descending trend and the 1.0452 level. The price made a very bullish move, reaching 1.0668 with no corrections. But this, in itself, could be the actual issue: the bulls overextended themselves.

After the first confirmation of 1.0668, the price retraced and confirmed 1.0546 as support, triggering another upwards move that failed on May 08, 2019, to add to any advance, as it printed a very strong upper tail. Such a move from the bears side shows that they are determined to take the price lower, 1.0452 being a first target. If the bulls manage to bring and keep the price above 1.0546, then another rise towards 1.0668 could be possible.

Short-term perspective

The price is in a flat limited by 1.0731 as resistance and 1.0542 as support. But the support is easily giving way, as the price looks like it pierced the support and is now trying to confirm it as a resistance. If it succeeds, 1.0487 would be a prime target.

On the other hand, if a consolidation occurs above 1.0542, the path to 1.0625 and 1.0672 would still be open.

Levels to keep an eye on:

D1: 1.0546 1.0452 1.0668

H4: 1.0542 1.0487 1.0625 1.0672

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.