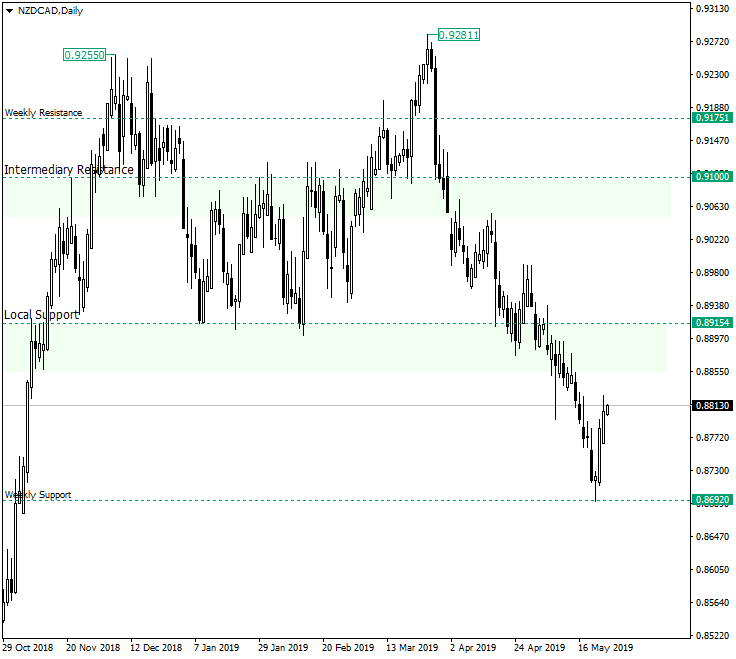

The New Zealand dollar versus the Canadian dollar appreciated after confirming the important weekly 0.8692 support.

Long-term perspective

After the drop from 0.9811, that began as the bulls were not able to keep the gains above 0.9175, the price reached the 0.8692 important support area, an area that on the weekly chart shows its strength by keeping in check most of the bearish endeavors of driving the prices under it. Given the will of the bulls to keep this level at all costs, the price printed a hammer candlestick pattern on May 22, 2019, that was confirmed by the fact that it was followed by a long bullish candle.

From this point onward — of course, for the near future — there are two possible scenarios: the price corrects slightly and heads towards 0.8915 or a double-bottom (or perhaps a triple bottom) forms around the weekly support area, with the same rally towards 0.8915.

Of course, the possibility of a breach can not be ruled out, as major fundamental events are capable of turning situations upside down, but as long as the price oscillates above 0.8692 the bulls are in charge.

Shot-term perspective

The descending move etched a low at 0.8691 and then started a correction that reached the double resistance formed by the resistance trendline of the downwards channel and the 0.8825 level. As long as this resistance is respected the descent can continue. On the other hand, a piercing could send the price to 0.8854 and subsequent resistance levels.

Levels to keep an eye on:

D1: 0.8692 0.8915

H4: 0.8825 0.8691 0.8895 0.8928 0.8984

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.