- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 31, 2019

May 31

May 312019

Chinese Yuan Weakens As Manufacturing Activity Contracts

The Chinese yuan is weakening against major currency rivals at the end of the trading week, driven mainly by disappointing economic data, as well as the lingering trade war with the Americans. The yuan has had a rough second quarter against the US dollar, but it has mostly gained against the euro so far this year. China has had a mix of highs and lows this year â both on data and trade. According […]

Read more May 31

May 312019

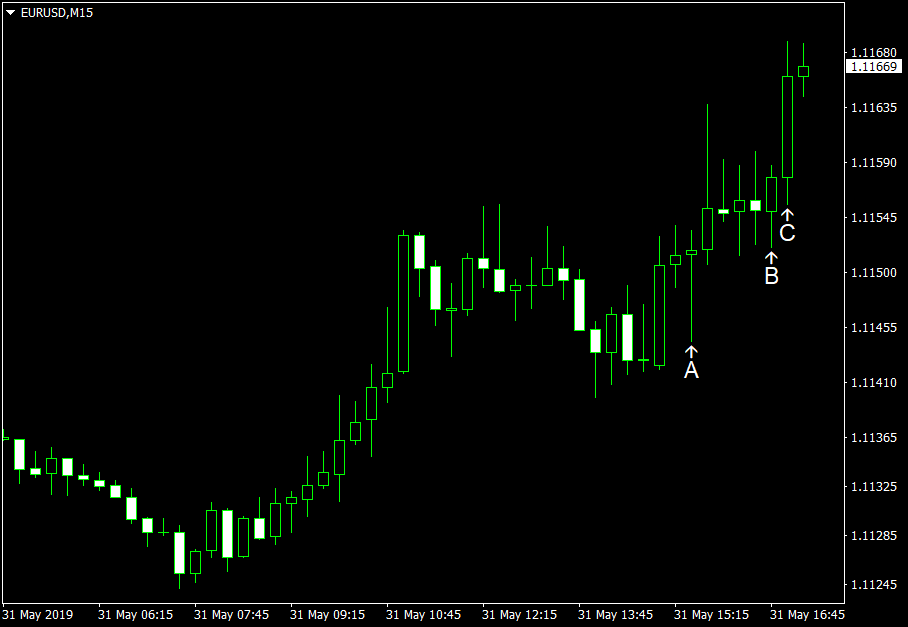

Euro Falls on Weak German Yields, Rallies as US 10-Year Yields Drop

The euro today fell against the US dollar during the Asian session driven by investor sentiment and the greenback’s rally amid global trade tensions. However, the EUR/USD currency pair recovered and rallied higher as the US 10-year Treasury yields fell to record lows driven by rising US bond prices as investors sought safety in them. The EUR/USD currency pair today rallied from a low of 1.1124 in the Asian session to a high of 1.1179 in the early American […]

Read more May 31

May 312019

EUR/USD Gains Despite Risk Aversion, Poor Eurozone Data

EUR/USD gained today as the euro was strong against other most-trade currencies despite markets being dominated by risk aversion. Traders were generally favoring safer currencies after US President Donald Trump talked about tariffs on imports from Mexico. It is surprising to see the euro strong in such environment. What makes it even more puzzling is today’s macroeconomic reports in the eurozone, all of which were […]

Read more May 31

May 312019

Risk Aversion, Falling Crude Oil Prices Overshadow Canada’s Data, CAD Drops

Macroeconomic data released in Canada today was very good, but it did not prevent the Canadian dollar from falling. Risk aversion caused by trade wars and falling prices for crude oil, Canada’s major export, were responsible for the currency’s lackluster performance. Canada’s gross domestic product rose 0.5% in March after falling 0.2% in April. That was a bit bigger increase than a 0.4% gain predicted by analysts. […]

Read more May 31

May 312019

Aussie Soft due to Risk Aversion, Chinese Data

As many other currencies, the Australian dollar was soft today due to risk aversion caused by escalating US trade wars. Poor China’s macroeconomic data was not helping to improve the traders’ mood either. China’s official manufacturing Purchasing Managers’ Index fell from 50.1 in April to 49.4 in May, missing the average forecast of 49.9. The indicator was below the neutral 50.0 level, indicating contraction of the sector. The non-manufacturing PMI was […]

Read more May 31

May 312019

Yen Thrives amid Risk Aversion, Ignores Domestic Data

There were plenty of macroeconomic reports released in Japan today. They were mixed, failing to provide a clear picture of Japan’s economic well-being. But as it often happens, the yen largely ignored domestic data. Instead, the currency surged against other most-traded currencies due to risk aversion on the Forex market. US President Donald Trump twitted about plans to impose tariffs on Mexican imports, and that triggered flight to safety among […]

Read more May 31

May 312019

Peso Sinks After Trump Targets Mexico with Tariffs

The Mexican peso tanked today, logging huge losses, after US President Donald Trump signaled that Mexico will be another target for US trade wars. Trump signaled that the United States will impose 5% tariff on all Mexican goods and will be increasing it further if Mexico does not stop illegal migrants coming to the USA. He twitted: On June 10th, the […]

Read more May 31

May 312019

Bears Triumph on CAD/JPY

After the bulls failed to mark their presence in the market, the bears took a decisive move and brought the price under 81.30. Long-term perspective After the appreciation from the 78.22 low, the price on the Canadian dollar versus the Japanese yen currency pair respected some important graphical landmarks. The first is the 81.38 solid support area, which the price had to confirm in order to continue the upwards move. As it did so, 82.71 was pierced […]

Read more