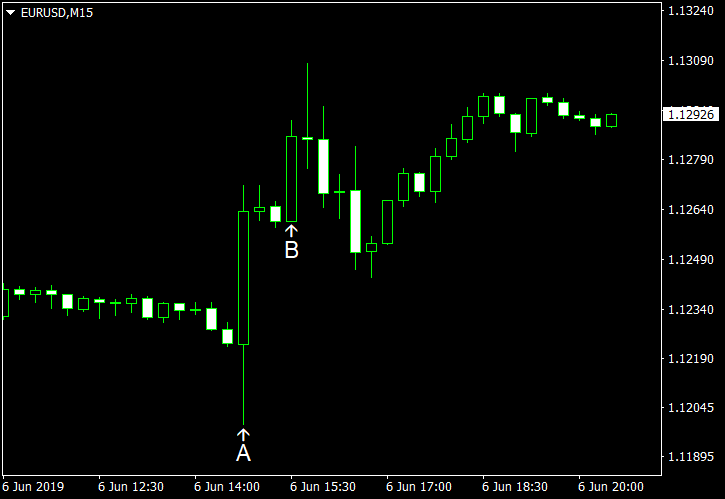

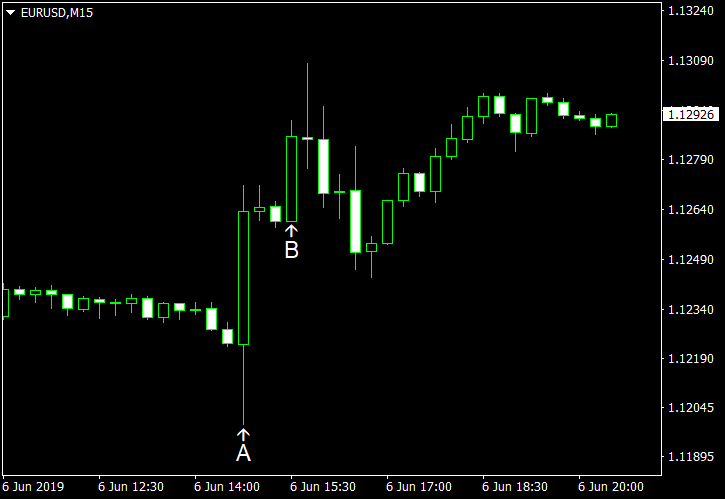

EUR/USD was somewhat volatile after today’s monetary policy meeting of the European Central Bank but ultimately decided to go higher. (Event A on the chart.) ECB President Mario Draghi signaled that the central bank does not plan interest rate hikes until at least mid-2020, but markets decided that his stance was not that dovish. (Event B on the chart.) As for US macroeconomic data, it was largely within expectations.

Nonfarm productivity rose 3.4% in Q1 2019. Analysts were expecting the same 3.6% rate of growth as in the previous quarter. (Event B on the chart.)

US trade balance deficit shrank to $50.8 billion in April from $51.9 billion in March. The actual value was close to the median forecast of a $50.5 billion deficit. (Event B on the chart.)

Initial jobless claims were at 218k last week, unchanged from the previous week’s level. Experts had predicted a small decrease to 215k. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.