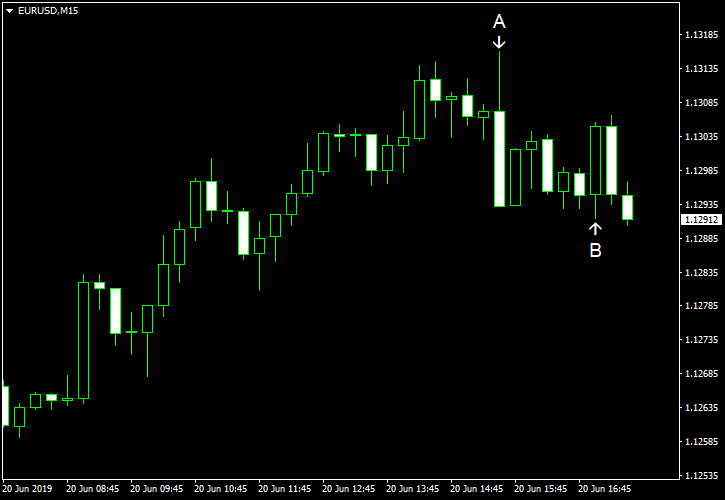

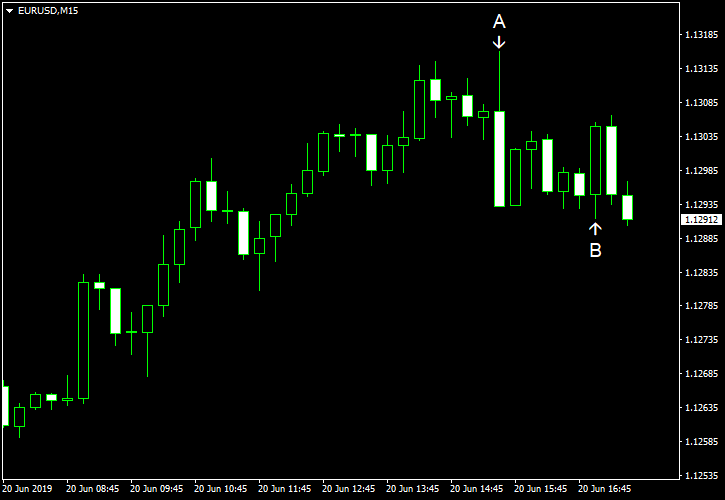

EUR/USD extended yesterday’s rally today as the US dollar remained extremely weak due to unexpectedly strong dovishness of the Federal Reserve. US macroeconomic data was not helping the greenback either as almost all indicators released today failed to meet expectations.

Philadelphia Fed manufacturing index dropped from 16.6 in May to 0.3 in June, far below the forecast level of 10.6. (Event A on the chart.)

Current account balance deficit narrowed to $130.4 billion in Q1 2019 from $143.9 billion in Q4 2018 (revised). Economists had predicted a smaller shortage of $125.0 billion. (Event A on the chart.)

Seasonally adjusted initial jobless claims fell to 216k last week from the previous week’s unrevised level of 222k. The median forecasts had promised a figure of 220k. (Event A on the chart.)

Leading indicators showed no change in May. Economists were counting on the same rate of growth as 0.1% logged in April (revised from 0.2%). (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.