- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 18, 2019

July 18

July 182019

Canadian Dollar Soft After Crude Oil Drops 2%

The Canadian dollar was performing extremely poor today. While the loonie has managed to erase intraday losses versus the US dollar by now, the Canadian currency remained below the opening level against other most-traded rivals. The most likely reason for the drop was the decline of crude oil prices. Positive Canadian employment data did little to help the currency. Futures for crude oil fell about 2% on Thursday due to a range of negative […]

Read more July 18

July 182019

Sterling Gets Boost from Brexit News, Strong Retail Sales

The Great Britain pound was one of the strongest currencies today, gaining on most of its major rivals, though failing to gain on the extremely strong Australian dollar and almost erasing gains versus the New Zealand dollar. The factors supporting the currency were a reduced chance of a no-deal Brexit and a surprisingly good retail sales report. Investors were concerned that Boris Johnson, the most likely candidate for the seat of the prime minister, may push for a no-deal […]

Read more July 18

July 182019

AUD/USD Facing an Important Test Before Continuing Towards 0.7200

The Australian dollar versus the US dollar currency pair is at an important resistance area, but the bulls are very determined. The clues for which path the price will take lie in a few details. Long-term perspective The price is in a downwards movement since the mid of 2018, but is also limited by the support of 0.6858 and the resistance area of 0.7055 and 0.7013. Between this support and resistance zones the waves typical for a consolidative phase took shape. […]

Read more July 18

July 182019

Euro Drops on Fears of Further Monetary Easing From the ECB

The euro today fell from its daily highs against the US dollar as markets reacted to news that the European Central Bank was considering a different approach to meet its inflation target. The EUR/USD currency pair later recovered given that the greenback was also under significant selling pressure as markets continue to price in a Fed rate cut on July 31. The EUR/USD currency pair today fell from a session high […]

Read more July 18

July 182019

Weak Employment Data Doesn’t Prevent Rally of Australian Dollar

Australian employment data came out today much weaker than was expected. Yet that did not prevent the Australian dollar from rising against the majority of its most-traded peers. The Australian Bureau of Statistics reported that the seasonally adjusted number of employed people increased by a meager 500 in June from the previous month, whereas analysts had predicted a solid increase of 9,100. The May increase got a positive revision from […]

Read more July 18

July 182019

Yen Mixed Despite Shrinking Trade Deficit

The Japanese yen was mixed today, rising against some majors, such as the US dollar and the euro, but falling against commodity currencies as well as the Great Britain pound. The decline of global stocks and domestic macroeconomic data were supportive of the currency, but that was not enough to bolster the yen sufficiently. Japan’s trade balance deficit shrank to Â¥0.01 trillion in June down from Â¥0.62 trillion in May. Exports gained 4.8%. […]

Read more July 18

July 182019

Swiss Franc Flat As Trade Surplus Balloons in June

The Swiss franc is trading relatively flat against some of its currency rivals on Thursday as some recent economic data are pushing up the safe-haven asset. While not consider the global beacon of exports, Switzerland has enjoyed a significant jump last month, helping it experience the biggest trade surplus in more than two years. With Zurich engaged in terse discussions with the European Union (EU), this could […]

Read more July 18

July 182019

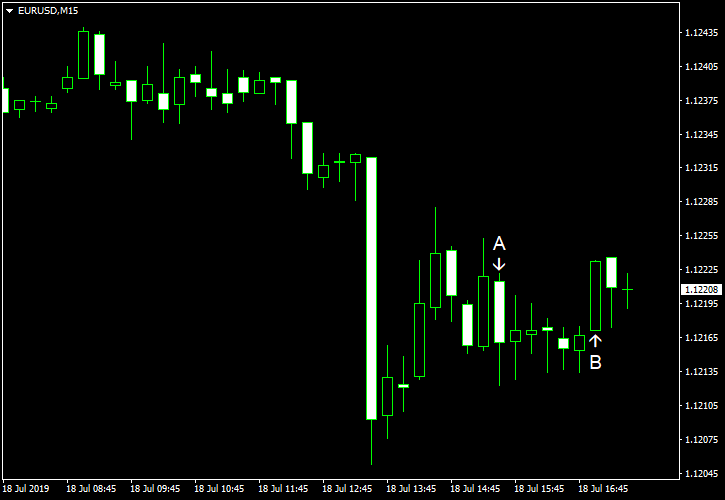

EUR/USD Retreats Sharply After Attempting to Rally

EUR/USD rose intraday but fell sharply later. The currency pair was trading in a range afterward. Philadelphia Fed manufacturing index jumped sharply from 0.3 in June to 21.8 in July. Analysts had predicted a much more modest growth to 5.0. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted level of 216k last week, matching forecasts exactly, up from 208k the week before. (Event A on the chart.) Leading […]

Read more