- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 5, 2019

August 5

August 52019

Euro Rallies Amid US Dollar Sell-Off Driven by Rising Trade Tensions

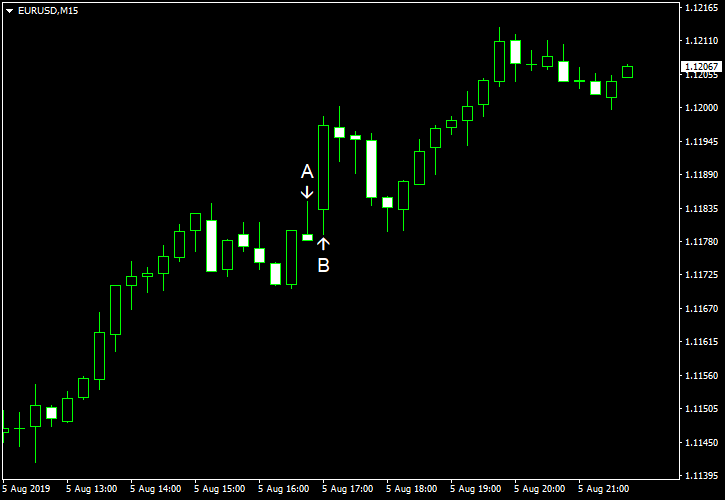

The euro today rallied higher against the US dollar as investors fled the greenback and US equity markets in favour of riskier assets such as the single currency. The EUR/USD currency pair today rallied above the crucial 1.1200 level as investors piled into the currency given the US dollar’s crash in the face of rising trade tensions. The EUR/USD currency pair today rallied from an opening low of 1.1107 to a high of 1.1213 in the American session and was near […]

Read more August 5

August 52019

Chinese Yuan Crashes Below Crucial USD Level Amid Trump Tariffs

The Chinese yuan fell below a key level against the US dollar to kick off the trading week after President Donald Trump announced new tariffs on billions in Chinese goods. While some experts posit that it might not have any economic significance, the trend could escalate tensions between the worldâs two largest economies over trade and the exchange rate — two topics important to Washington. Last week, the White […]

Read more August 5

August 52019

AUD/USD Declines for Twelfth Session on Range of Factors

The Australian dollar declined today, falling for the twelfth consecutive session against its US counterpart. There were plenty of reasons for the decline: unfavorable domestic macroeconomic data, poor economic reports in China, escalation of US-China trade tensions. The Australian Industry Group Australian Performance of Services Index dropped from 52.2 in June to 49.3 in July. That was the biggest drop in a year. Furthermore, being below the neutral 50.0 level, the indicator suggested […]

Read more August 5

August 52019

EUR/USD Rallies amid Escalating US-China Trade Tensions

EUR/USD surged today despite risk aversion on the Forex market. Market analysts speculated that the escalating trade tensions between the United States and China, which were causing the risk aversion, was actually the reason for the surge of the currency pair as prospects for a trade war were hurting the greenback. The outlook for another interest rate cut from the Federal Reserve in September was also hurting the US currency. Markit services PMI climbed to 53.0 […]

Read more