- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 22, 2019

August 22

August 222019

Euro Attempts to Hold Ground amid Clashing Fundamentals

The euro was relatively firm today, though the currency fell against some of its rivals, most notably the extremely strong Great Britain pound. Fundamentals clashed, with positive macro releases pushing the currency up but the dovish stance of the European central bank driving it down. PMI figures released on Thursday for France, Germany, and the whole eurozone showed an improvement in August compared with the previous month. On top of that, all […]

Read more August 22

August 222019

Sterling Rallies on Merkelâs Optimism Regarding Irish Backstop

The British pound today exploded higher after the German Chancellor Angela Merkel expressed optimism that the Irish backstop issue could be resolved by October 31st. The GBP/USD currency pair rallied to new monthly highs above the crucial 2.2250 level as traders bought the Sterling in anticipation that her remarks would help prevent a no-deal Brexit scenario. The GBP/USD currency pair today rallied from a low of 1.2108 in the early London […]

Read more August 22

August 222019

USD/IDR Flat After Bank Indonesia Cuts Interest Rates

The Indonesian rupiah was about flat versus the US dollar today after Indonesia’s central bank lowered interest rates. The Bank Indonesia lowered its benchmark 7-day Reverse Repo Rate by 25 basis points to 5.5% today. The central bank reduced other interest rates by 25 basis points as well. The statement cited the following reasons for the decision: The policy is consistent with low inflation projected below the midpoint of the target […]

Read more August 22

August 222019

Japanese Yen Firm on PMI Figures, Cautious Market Sentiment

The Japanese yen was firm today as the market sentiment turned cautious. Some of domestic macroeconomic releases were also helpful to the currency. Japan’s Flash Manufacturing PMI edged up by notch from 49.4 in July to 49.5 in August. Analysts had expected a bigger increase to 49.8. The Flash Services Business Activity Index demonstrated a far bigger improvement, climbing from 51.8 to 53.4. Joe Hayes, economist at IHS Markit, commented on the result: […]

Read more August 22

August 222019

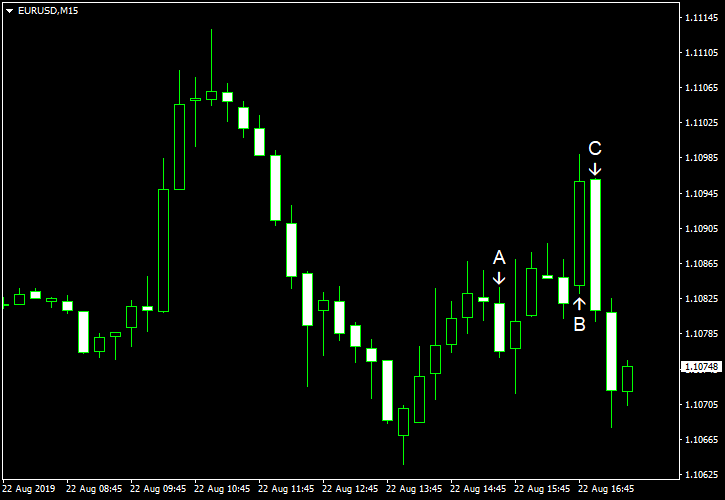

EUR/USD Remains Volatile After Eurozone PMIs, ECB Meeting Minutes

EUR/USD remained volatile today. The currency pair rallied sharply on positive eurozone PMI figures but retreated afterward. The pair attempted to rally once again after the European Central Bank released minutes of its latest monetary policy minutes. But EUR/USD failed to maintain rally once again and is now trading below the opening level. Initial jobless claims were at the seasonally adjusted level of 209k last week, down […]

Read more August 22

August 222019

Aussie Weakens After Australia’s PMIs Fall

The Australian dollar fell today amid the cautious market sentiment and domestic macroeconomic data that was not particularly good. Yet the losses were limited and currency managed to trim them against some rivals. The Commonwealth Bank Flash Manufacturing PMI fell to 51.3 in August from 51.6 in July. Being above the neutral 50.0 level the index showed that the sector continued to expand but with a slower pace. At the same time, […]

Read more August 22

August 222019

Russian Ruble Gains on Calls for G7 Reinstatement

The Russian ruble is gaining on Thursday after renewed calls to reinstate Moscow into the G7. After being ousted from the group of eight economies over the annexation of Crimea in 2014, Russia might return to the table and engage with other economic powerhouses. Data is also lifting the ruble toward the end of the trading week. On Wednesday, meeting with Romanian President Klaus Iohannis, President Donald Trump reiterated past support for allowing […]

Read more August 22

August 222019

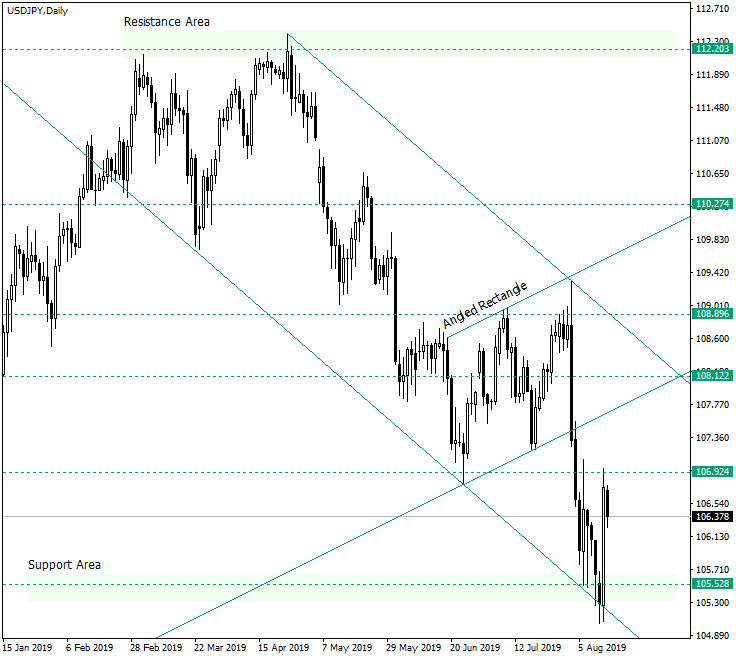

Appreciations on USD/JPY Limited by 107.00

The US dollar versus the Japanese yen currency pair seems to met difficulties in its appreciation attempts, not being able to pass the 107.00 psychological level. Long-term perspective The impulsive wave that started at the triple resistance area — consolidated by the 108.89 level, the resistance line of the angled rectangle, and the upper line of the descending channel — stopped at 105.52, an important weekly support area. From there on August 13, the market printed a strong bullish bar […]

Read more