The US dollar versus the Japanese yen currency pair bounced off 106.92 and is now trying to conquer 108.12.

Long-term perspective

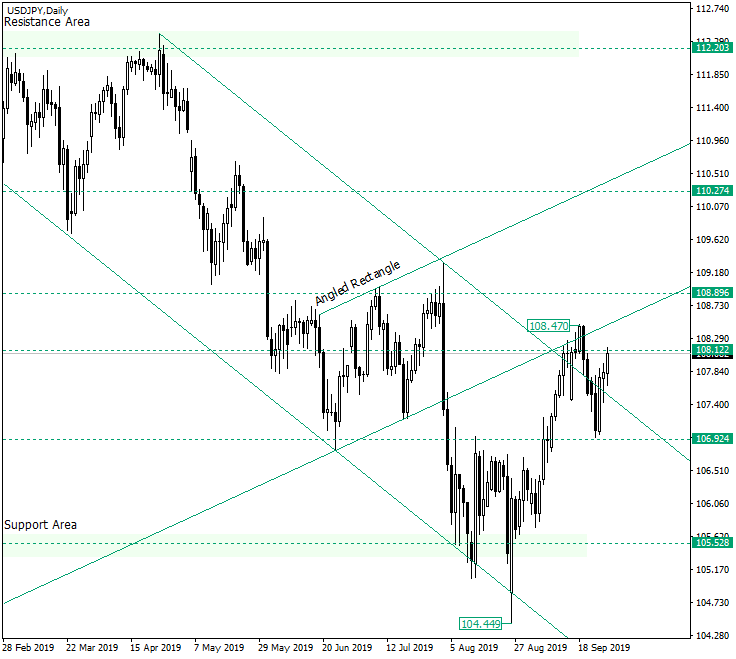

After the low printed at 104.44, the price reached the resistance area marked by the upper line of the descending channel, the lower line of the angled rectangle, and the 108.12 level. It pierced the upper line of the descending channel only to stop at the lower line of the angled rectangle. At that moment the expectations were for the descending line to become a support and propel the price towards the north. However, the price returned into the descending channel, leading to the idea that the break has been a false one.

But the price found support at 106.92, from where it started a new rally that, once more, pushed the price outside of the descending channel. At the time of writing the price oscillates around the 108.12 level.

It is way too early to asses the possibility for a continuation pattern (such a descending rectangle) to form, but the price could stop at the previous peak — 108.47 — and form a flat limited by 108.47 as resistance and 106.92 as support.

A daily close above 108.12 or a confirmation of it as support, could favor an upward movement towards the double resistance etched by the lower line of the angled rectangle and the 108.89 level, which if confirmed as support, open the door to 110.27.

Short-term perspective

The price got out of the ascending channel only to stop at the 107.08 support, from where it changed direction and secured 107.55.

As long as 107.08 is not taken out, the appreciation is expected to continue, targeting 108.49 first and then 109.12.

Levels to keep an eye on:

D1: 108.12 108.89 110.27

H4: 108.49 109.12 107.55 107.08

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.