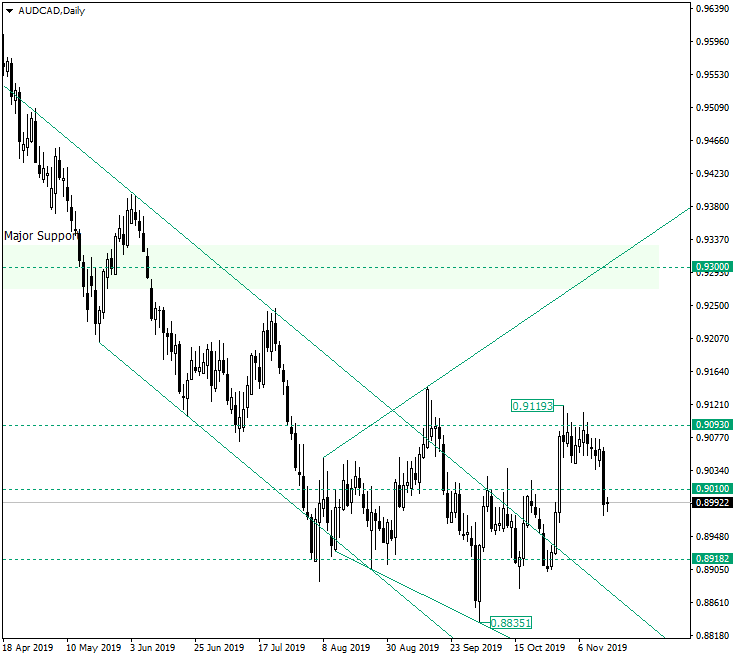

The Australian dollar versus the Canadian dollar currency pair might be poised for the downside after appreciation attempts failed. But will the bulls try once more?

Long-term perspective

After bottoming around the 0.8918 support, the price printed an upwards pointing movement, trying to acquire 0.9093.

In the context of the appreciation being a piercing of the resistance of a trend at the end of which a diamond pattern crystallized, the expectations were for the bulls to be determined and overcome the bearish resistance concentrated at 0.9093.

But after consolidating under their target, the bulls dropped their guard. As a result, the price plumbed under the 0.9010 level, which not too long ago was passed by the price like it was not there.

However, now the bears could lock-on this level in order to prepare further decline.

So, if the bulls manage to pull themselves together rather quickly and confirm 0.9010 as support (at least with a candle that closes above it), then they could actually make a higher high with respect to 0.9119, which greatly increases their chances of maintaining their dominance and reaching the 0.9200 psychological level — not highlighted on the chart.

On the other hand, if any bullish comeback attempts fail and the price consolidates under 0.9010, then 0.8918 will be visited yet again.

Short-term perspective

The price consolidated under the resistance of 0.9105 and the support of 0.9014.

After the support gave way, the price found support — at least for the time being — at the next important area of 0.8985. The bulls might try an appreciation from here, targeting 0.9041, but in the context of the discussion for the long-term, any longing attempts should be considered with caution.

If 0.8985 finally gives way, then 0.8923 is the next bearish target, followed by 0.8872.

Levels to keep an eye on:

D1: 0.9010 0.8918 0.9093 0.9200

H4: 0.9014 0.8985 0.8923 0.8872

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.